APRIL 2025 MARKET COMMENTARY

MARKET RECAP

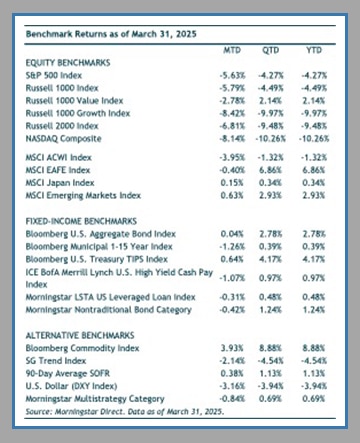

In the first quarter of 2025, the global stock market exhibited wide-ranging performances across regions and asset classes. The S&P 500 entered correction territory in the first quarter, dropping more than 10% from its mid-February high as investor sentiment weakened amid trade tensions and policy uncertainty. Stocks ended the quarter down nearly 5%. In contrast, many European and Asian markets rose sharply. Germany’s market (MSCI Germany Index) gained nearly 19% following a fiscal policy shift towards increased defense spending that boosted market confidence and pushed stocks higher. Chinese stocks (MSCI China Index) rose nearly 17%, seemingly driven by a few factors including government stimulus and advancements in artificial intelligence. China’s meaningful weight in the emerging-market index, lifted emerging markets 2.9% (MSCI Emerging Markets) in the period.

In the U.S., large-cap stocks (S&P 500) fell nearly 5%, outperforming small-cap (Russell 2000) which fell nearly 7%. Large-cap growth stocks, which had led the market for an extended period, finally lagged this quarter as investors rotated into value and foreign stocks amid economic uncertainty. Large-cap value stocks (Russell 1000 Value) gained nearly 3%, widely outperforming large-cap growth’s (Russell 1000 Growth) nearly 8% decline.

The equal-weighted S&P 500 was slightly positive in the quarter, outperforming the cap-weighted index, signaling the decline of Magnificent 7, which comprised one-third of the S&P 500 index at the start of the year. The Bloomberg Magnificent 7 Index was down 16% in the quarter. More speculative assets such as Bitcoin also fell, while investors’ anxiety was good for gold which reached a new high.

Within fixed-income, both credit and interest-rate sensitive sectors posted gains in the quarter. The 10-year Treasury yield experienced significant volatility throughout the quarter, fluctuating amid shifting inflation expectations, Federal Reserve policy signals, and broader market uncertainty. Overall, 10-year Treasury rates ended up slightly lower, falling from 4.57% to 4.36%, and investment-grade core bonds (Bloomberg U.S. Aggregate Bond Index) rose just over 2% in the quarter. Credit-sensitive bonds such as high-yield held up well, gaining 1.5%. The overall outlook for bonds in 2025 is positive, with higher current yields likely resulting in calendar-year returns that exceed inflation.

Performance in the first quarter was a great reminder of the benefits of diversification. Unexpected losses in U.S. stocks (growth stock in particular) were offset by gains in U.S. large cap value stocks, foreign stocks, and investment grade bonds.

INVESTMENT OUTLOOK

Heading into the year, we expressed caution that elevated stock market valuations, especially for U.S. technology companies, combined with policy uncertainty, could leave the market vulnerable to volatility. Indeed, this is what transpired over the first quarter of the year.

After hitting new highs in on February 19th, U.S. stocks suffered their first “correction” since 2023, when the S&P 500 index declined a total of 10% through March 15. The narrative around U.S. stocks started to shift in late-January beginning with the release of DeepSeek, a Chinese built Artificial Intelligence model that is seen as a direct threat to U.S. tech companies’ dominance of the AI industry. The selloff in U.S. stocks was exacerbated in early February amid tensions around trade, tariffs, and policy uncertainty.

As we entered the second quarter, President Trump shocked investors on April 2 during what he declared as “Liberation Day,” when he announced a comprehensive set of much higher-than-expected tariffs. These included a 10% baseline tariff on all imports and unexpected and significantly higher tariffs for certain trade partners, such as 54% for China and 20% for the European Union. These tariffs in aggregate, if implemented and maintained, would result in the effective tariff rate on all imports rising to 24%, putting it at a 125-year high.

In response to Trump’s early-April announcement, equity markets suffered sharp declines, with the S&P 500 Index suffering its second correction of the year, dropping roughly 10% in the two days following the announcement. European and Asian stock indexes also fell meaningfully. The U.S. dollar weakened against major currencies, and longer-term interest rates fell over fears of an economic slowdown.

Leading up to “Liberation Day,” economic conditions in the U.S. were reasonable and the overall economic backdrop was relatively stable. Despite ongoing volatility and concerns about slowing growth, we still saw some supportive underlying economic fundamentals. For example, corporate earnings continued to surprise to the upside, with many companies exceeding expectations and maintaining strong profit margins. GDP was still expanding, albeit at a slower pace, reflecting a resilient economy even in the face of higher interest rates. Meanwhile, the labor market remained in decent shape, with unemployment at historically low levels and key sectors such as construction, healthcare, technology, and professional services still adding jobs. Furthermore, consumer spending remained relatively steady, and businesses were yet to signal widespread distress.

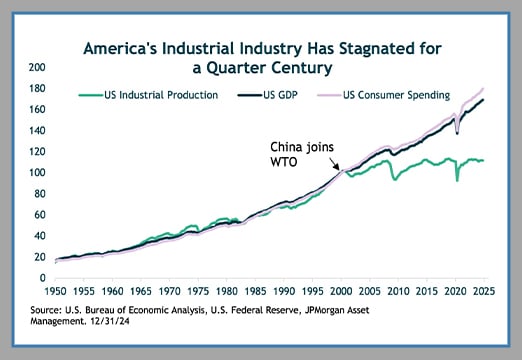

President Trump’s fondness for tariffs is documented going back decades and he campaigned on the issue since his emergence onto the political scene. He and others in his administration view tariffs as a tool to make American manufacturing more competitive with other countries. Over the last few decades, American manufacturing has been hollowed out for lower cost manufacturing abroad. Free trade agreements were great for corporate profits but ended up terrible for the American worker. Americans received cheaper goods but many manufacturing jobs moved overseas (mainly to China). Globalization made it easy to substitute domestic workers for cheaper foreign labor. This has resulted in many negative consequences for communities throughout America. The administration would like to increase the size of the manufacturing sector.

CLOSING THOUGHTS

It goes without saying that tariffs and trade policy have injected a big dose of uncertainty into the financial markets, and we understand that such developments can be worrying. There are still many lingering questions, including what potential retaliatory measures will come from countries hit with tariffs, whether the announced tariff levels will remain in place or possibly be lowered, and what their ultimate impact will be on the financial markets. Until there is more clarity, the volatile environment will likely continue.

Currently, it seems like stock prices are at least reflecting some of the bad/unexpected news regarding tariffs. While many foreign and U.S. economies were in relatively good shape prior to the Liberation Day, Trump’s tariff announcement has led us to raise the probability of a recession. We are actively assessing a range of economic outcomes and their impact on the markets.

The current market environment is noisy, volatile, and frankly, too tough to call with confidence. More than ever, we believe it’s important to stay disciplined and avoid making reactive portfolio shifts. This is a challenging environment, but one that reinforces the importance of diversification, patience, and a clear investment process.

DISCLOSURE:

For discretionary use by investment professionals. Portions of this document are provided by iM Global Partner Fund Management, LLC (“iMGPFM”) for informational purposes only and no statement is to be construed as a solicitation or offer to buy or sell a security, or the rendering of personalized investment advice. There is no agreement or understanding that iMGPFM will provide individual advice to any investor or advisory client in receipt of this document. Certain information constitutes “forward-looking statements” and due to various risks and uncertainties actual events or results may differ from those projected. Some information contained in this report may be derived from sources that we believe to be reliable; however, we do not guarantee the accuracy or timeliness of such information. Investing involves risk, including the potential loss of principal. Any reference to a market index is included for illustrative purposes only, as an index is not a security in which an investment can be made. Indexes are unmanaged vehicles that do not account for the deduction of fees and expenses generally associated with investable products. A list of all recommendations made by iMGPFM within the immediately preceding one year is available upon request at no charge. For additional information about iMGPFM, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website (adviserinfo.sec.gov) and may otherwise be made available upon written request.

Certain material in this work is proprietary to and copyrighted by iM Global Partner Fund Management, LLC and is used by OJM Group with permission. Reproduction or distribution of this material is prohibited and all rights are reserved.

For informational purposes only. OJM Group, LLC is an investment adviser registered under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply any level of skill or training. For more information about OJM Group please visit https://adviserinfo.sec.gov/ or contact us at 877-656-4362. Not intended as legal or investment advice or a recommendation of any particular security or strategy. Information prepared from third-party sources is believed to be reliable though its accuracy is not guaranteed. Investing involves risk and possible loss of principal capital. Past performance is not indicative of future results.

Index Disclosure: An index is an unmanaged portfolio of specific securities, the performance of which is often used as a benchmark in judging the relative performance of certain asset classes. Investors cannot invest directly in an index. An index does not charge management fees or brokerage expenses, and no such fees or expenses were deducted from the performance shown. Index returns shown are price returns, which exclude dividends and other earnings.