Q3 2024 INVESTMENT COMMENTARY

MARKET RECAP

It was far from a quiet summer for the financial markets. Markets have been volatile as investors parsed through economic data attempting to gauge whether the economy will slow, and how much the Federal Reserve would need to lower interest rates to prevent a recession. Toward the end of the quarter, the Fed opted for a bold start to its shift in policy, reducing rates by a half percentage point. This was the first cut since 2020, and Fed Chair Jerome Powell said the larger-than-average cut was intended to show the Fed’s commitment to “maintaining our economy’s strength” in the face a slowdown in the labor market. Year to date, the economy has proven resilient thanks to strong consumer spending, lower inflation, and healthy corporate earnings.

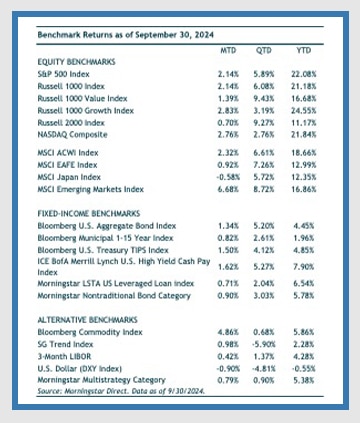

Despite the volatility, the stock market reached new highs with the S&P 500 gaining 5.9% in the third quarter, pushing its year-to-date return to 22.1%.

Notably, there was a rotation out of large-cap growth tech stocks and into a broader range of sectors and styles. The Nasdaq, which led the market higher in the first half of the year, gained 2.8% but lagged other benchmarks in the quarter. Large-cap value (Russell 1000 Value) gained 9.4% and outperformed large-cap growth’s (Russell 1000 Growth) 3.2% gain, and small-caps (Russell 2000) rose 9.3% outpacing large-caps’ (Russell 1000) 6.1% gain. The equal-weighted S&P 500 index (up 9.6%) easily outperformed the cap-weighted S&P 500 during the quarter. At the sector level, traditional defensive sectors were by far the big winners, with utilities, real estate, and consumer staples gaining 19.4%, 17.2%, and 9.0%, respectively.

Internationally, developed international stocks (MSCI EAFE) gained 7.3%, finishing ahead of domestic stocks in the three-month period. Emerging markets stocks (MSCI EM Index) were relatively quiet for most of the quarter but rose sharply in the last week of the period after China announced their boldest stimulus in years in attempt to boost their ailing economy. Emerging-markets stock finished the quarter up 8.7% thanks to a 23.5% gain for China during the month of September.

Within the bond markets, returns were positive across most fixed-income segments. The benchmark 10-year Treasury yield declined from 4.36% to 3.81% amid lower inflation and recession concerns. In this environment, the Bloomberg U.S. Aggregate Bond Index gained 5.0% and credit performed well in the quarter as high-yield bonds (ICE BofA Merrill Lynch High Yield Index) were up 5.5% in the quarter.

Overall, domestic economic and corporate fundamentals remained relatively healthy in the quarter, although rich valuations remain a risk. Looking ahead, the expectation is that the Fed will continue to cut rates this year and next in an effort to guide the economy to a soft landing and avoid a recession.

For discretionary use by investment professionals. Portions of this document are provided by iM Global Partner Fund Management, LLC (“iMGPFM”) for informational purposes only and no statement is to be construed as a solicitation or offer to buy or sell a security, or the rendering of personalized investment advice. There is no agreement or understanding that iMGPFM will provide individual advice to any investor or advisory client in receipt of this document. Certain information constitutes “forward-looking statements” and due to various risks and uncertainties actual events or results may differ from those projected. Some information contained in this report may be derived from sources that we believe to be reliable; however, we do not guarantee the accuracy or timeliness of such information. Investing involves risk, including the potential loss of principal. Any reference to a market index is included for illustrative purposes only, as an index is not a security in which an investment can be made. Indexes are unmanaged vehicles that do not account for the deduction of fees and expenses generally associated with investable products. A list of all recommendations made by iMGPFM within the immediately preceding one year is available upon request at no charge. For additional information about iMGPFM, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website (adviserinfo.sec.gov) and may otherwise be made available upon written request.

Certain material in this work is proprietary to and copyrighted by iM Global Partner Fund Management, LLC and is used by OJM Group with permission. Reproduction or distribution of this material is prohibited and all rights are reserved.

For informational purposes only. OJM Group, LLC is an investment adviser registered under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply any level of skill or training. For more information about OJM Group please visit https://adviserinfo.sec.gov/ or contact us at 877-656-4362. Not intended as legal or investment advice or a recommendation of any particular security or strategy. Information prepared from third-party sources is believed to be reliable though its accuracy is not guaranteed. Investing involves risk and possible loss of principal capital. Past performance is not indicative of future results.

Index Disclosure: An index is an unmanaged portfolio of specific securities, the performance of which is often used as a benchmark in judging the relative performance of certain asset classes. Investors cannot invest directly in an index. An index does not charge management fees or brokerage expenses, and no such fees or expenses were deducted from the performance shown. Index returns shown are price returns, which exclude dividends and other earnings.