MARCH 2022 MARKET UPDATE

The Month at a Glance

- Both equities and fixed income posted losses for the second straight month

- The Russian invasion of Ukraine stoked volatility and injected significant geopolitical uncertainty into the market

- Oil prices eclipsed $100 a barrel—its highest level since 2014 and approaching levels not seen since before the Great Financial Crisis

MARKET RECAP

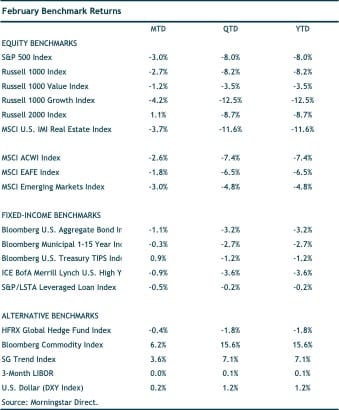

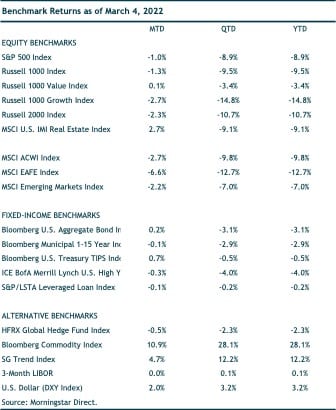

Most equity markets continued their downward trajectory in February, with the S&P 500 losing 3.0%. Surprisingly, the Russell 2000 Index posted a 1.1% gain, but is still down nearly 9% for the year. During the month, the S&P 500 was down as much as 12% from its all-time high earlier this year. Developed international equity markets fared better than the S&P 500, falling 1.8%, while emerging-markets stocks lost 3.0% for the month.

Much like in January, value stocks outpaced growth stocks—the latter continues to face the headwind of higher interest rates and subsequent impact on valuations. Year to date, the Russell 1000 Value Index is down 3.5% compared to a 12.5% drop for the Russell 1000 Growth Index.

There haven’t been many traditional asset classes that have produced positive gains so far in 2022. Core bonds—which investors have historically counted on as ballast in their portfolios—have fallen 3.2% over the first two months. Bonds have not acted as they typically do in risk-off markets due to the cocktail of rising interest rates, high inflation, and upcoming rate hikes from the Fed.

Among the rare gainers in 2022 are managed futures (trend-following) strategies, and our balanced portfolios have benefited from our allocation to managed futures funds this year. We continue to view them as attractive portfolio diversifiers and return-generators in this highly volatile environment for traditional stock and bond funds.

NOTABLE EVENTS

The major headline in February was the Russian invasion of Ukraine. Many Western governments responded with heavy sanctions on the Russian economy. The impact of those sanctions will mainly fall on the Russian economy.

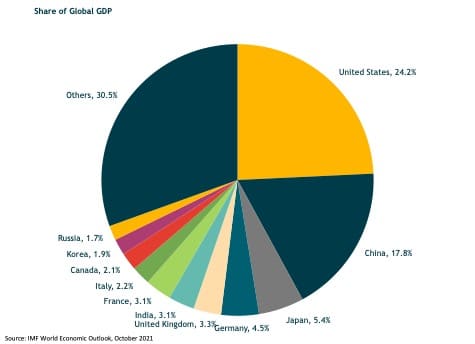

Based on IMF data, Russia is the 11th largest economy but is sub-2% of total global GDP. For comparison, the two largest economies—the United States and China—comprise 24% and 18% of global GDP, respectively. The global economy—and Europe in particular—could be impacted by higher energy costs given Russia is one the world’s largest exporters of oil and gas. Crude oil prices have jumped nearly $20 a barrel to over $100/bbl since the conflict started; and that is on top of oil’s 50% price surge in 2021