In our year-end 2018 commentary, we emphasized the wide range of plausible macroeconomic scenarios and financial market outcomes for the year ahead with the potential for either a positive or negative shorter-term path. Through the first half of 2019 we’ve gotten a little bit of everything—signs of both scenarios—though so far the ups have outpaced the downs.

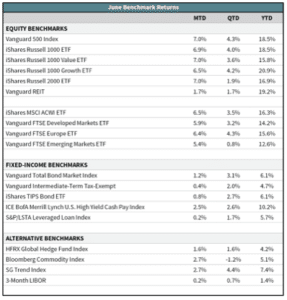

The first half of 2019 saw robust gains across nearly every asset class, including both core bonds and equities, but it certainly wasn’t a smooth ride. Among the primary drivers of the market sell-offs and their subsequent rebounds were on-again/off-again U.S.-China trade negotiations and two major shifts in central bank policy.

Emerging-market stocks, up just 0.8% for the second quarter, absorbed more of the uncertainty surrounding global trade tensions. Year-to-date, however, they have gained 12.6%.

In fixed-income markets, the 10-year Treasury yield dipped below 2% following the Federal Reserve’s June meeting. This was a near three-year low, reflecting promises of further easing later this year. These falling yields drove the core bond index to a 3.1% gain for the quarter and an impressive 6.1% return so far this year.

Market and Portfolio Outlook

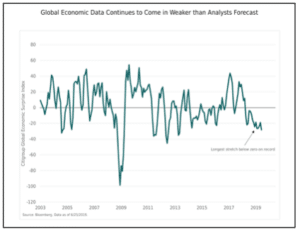

Not surprisingly, we still see a high degree of uncertainty and a wide range of plausible outcomes over the next 12 months (and beyond). But at the margin we think the macro risks have increased. Trade uncertainty has damaged global business confidence in what by many measures is an already weak global economy. While this damage is currently being offset by easier monetary conditions, the inevitable impact of any additional central bank rate easing is certainly muted.

The risk of a geopolitical shock on financial markets is also ever-present. Most recently, there is heightened potential for a military conflict with Iran. But there are many other potential geopolitical flashpoints and unknowns:

- Brexit remains unresolved.

- The tug of war between democracy, populism, nationalism, and autocracy continues around the globe.

- The 2020 U.S. presidential election will likely create additional market uncertainty.

- China’s rise and challenge of the United States as a global superpower goes well beyond just the current trade conflict.

- The Middle East (beyond Iran) remains a potential flashpoint, as does North Korea.

To what extent stock markets are already pricing in these fears and risks is also an unknown. On the heels of yet another strong quarter for U.S. stocks, their valuations are looking more stretched than ever. Our analysis of U.S. stock market valuations and expected returns implies the market consensus is discounting an overly optimistic outlook. An argument can be made that any investor chasing higher stock prices in response to the tailwind of monetary stimulus may face potential dangers.

On the other hand, we continue to have modestly overweight positions to European and emerging-market stocks. Our analysis indicates foreign equity valuations are very attractive relative to U.S. securities. In our assessment, these markets have accounted for poor macro news and slowing corporate earnings growth. Our base case generates high single-digit expected returns for European and emerging-market stocks over the medium-term horizon.

On the other hand, if the global economy continues to weaken and the United States experiences a bear market, our balanced portfolios, which own core bonds, alternative fixed income and alternative strategies, are expected to outperform stocks. As seen in the second quarter of 2019, these lower-risk, alternative positions tend to trail U.S. stocks during a raging bull market. Conversely, we have appreciated the benefits of risk mitigation assets during the occasional market correction, including the one experienced in last year’s fourth quarter.

In Closing

The past quarter illustrates that uncertainty is a constant presence and volatility can return to markets at the drop of a pin. Regardless of our tactical diversification efforts, those of us who own stocks need to be prepared to ride through the inevitable down periods. It’s the shorter-term price we pay to earn higher expected returns over the longer term.

This has been an unusually long U.S. economic and market cycle. But we firmly believe it is still a cycle, and that our patience and fundamental valuation discipline will be well-rewarded as it turns again. As always, we appreciate your ongoing confidence and trust, and we continue to work hard every day to earn it.