Moderating Inflation & Strong Jobs Market Improve Investor Sentiment

- Global equity markets roared 7.2% higher to start the year.

- Foreign equities (both developed and emerging) outpaced the S&P 500 in January.

- Amid moderating inflation and a strong jobs market, investor sentiment is starting to believe that a soft-landing scenario may play out.

- The Federal Open Market Committee (FOMC) downshifted the size of their rate increases to 25 basis points at the conclusion of their February meeting—resulting in a 4.5%-4.75% Fed Funds rate.

MARKET RECAP

Stock markets started 2023 with strong gains across the globe. Developed international stocks led the way with a gain of 8.1%. Emerging-markets stocks were not far behind with a return of 7.9% in January. International equities benefited from a softer US dollar during the month (the DXY index fell 1.4%). The S&P 500 performed well with a gain of 6.3% but was the laggard across the three main regions.

In a reversal from last year, growth stocks outpaced value stocks. The NASDAQ Composite booked a price gain of 10.7%, which was its best start to a year since 2001. (However, despite its strong January 2001 return, the NASDAQ Composite ultimately saw a price drop of 21% that year.) Traditionally more defensive areas of the market were laggards in January. Consumer staples, healthcare, and utilities sectors within the S&P 500 were all modestly negative last month.

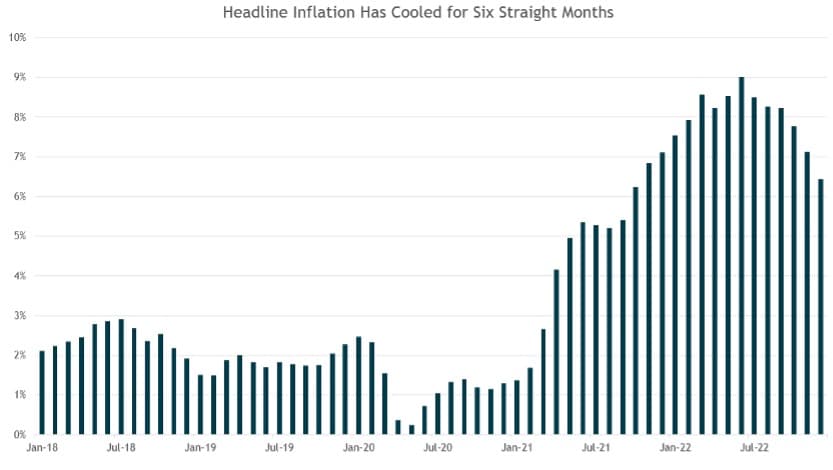

Investors continue to remain focused on inflation data and their resulting impact on monetary policy. The December CPI inflation reading was the sixth consecutive drop in headline inflation (see chart below). Since peaking at 9% in June, year-over-year headline CPI has fallen to 6.5%. Even though inflation remains well above the Fed’s 2% target, the direction it’s trending is viewed positively by investors. Better inflation data results in investors positioning for slower (and an eventual pause) in rate hikes by the Federal Reserve.

After downshifting to a 50 basis point rate increase in December, the FOMC again lowered the size of its hike in early February; on February 1st, the FOMC increased its target rate 25 basis points to 4.5%-4.75%. This increase was in-line with market expectations. Going forward, the market is pricing in two more rate hikes of 25 basis points—resulting in a target rate of 5%-5.25% at the Fed’s May meeting. Optimism that the hiking cycle is nearing its end helped both credit and duration outperform in the fixed income market in January. The Bloomberg U.S. Aggregate Bond Index gained 3.1% in January. U.S. high yield bonds returned 3.9%, while the riskiest segment of that market (CCC-rated and lower) gained an impressive 6.2% in the month. Throughout the month, the 10-year U.S. Treasury rate dropped from 3.88% to 3.52%—a full percentage point lower than the Fed Funds target rate, keeping the yield curve sharply inverted.

NOTABLE EVENTS

Though not technically in January, most market participants looked forward to the February 1st FOMC meeting and press conference. The increase of 25 basis points was expected and marked the 8th consecutive meeting where the Fed has raised its target rate by a cumulative 450 basis points. Markets looked upon Chair Powell’s speech favorably (i.e., dovish) and rallied on his comments. He noted that inflation data in recent months has shown “a welcome reduction in monthly pace of increases” and went on to acknowledge that the “disinflationary process has started.”

The disinflation that the Fed is currently seeing is coming from goods prices. Goods inflation has dropped to nearly 2% (year-over-year) in the latest figure (after increasing at over 12% at one-point last year). While this is clearly a welcome sign, Chair Powell did note the Fed is keeping an eye on inflation within the “core services excluding housing sector.” Services inflation has yet to turn meaningfully lower and is believed to be more sensitive to the labor market. And so, for the Fed to have “substantially more evidence to be confident inflation is on a sustained downward path,” the labor market will likely need to show weakness (which, so far, it hasn’t).

Specifically on the labor market, the recent non-farm payrolls number for January was significantly stronger than expectations (an increase of 517,000 compared to market consensus of 189,000). The data came out last Friday (February 3rd) and markets fell on the day due to concerns that the Fed may need to be more aggressive to slow the economy. The unemployment rate fell to a 53-year low of 3.4%. The jobs report was a huge beat and raises some questions about what the Fed will do next.