MAY MARKET UPDATE

THE MONTH AT-A-GLANCE

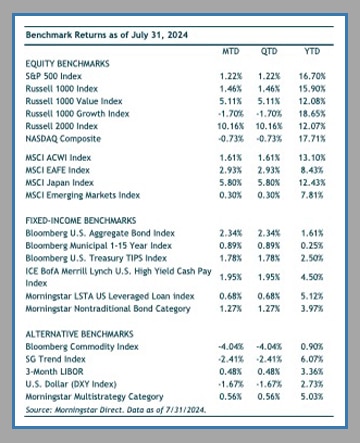

- Global equities (as represented by the MSCI ACWI Index) rose 1.6% during July with developed international markets leading the way.

- Under the hood, a sharp rotation out of U.S. mega-cap growth stocks and into smaller-cap and value stocks occurred in the second half of the month.

- The Federal Reserve held rates steady at their July meeting but set the stage for a cut in September.

- Longer-term rates steadily declined throughout the month—the key 10-year rate has fallen nearly 100 basis points from its high earlier in the year.

- An attempted assassination on former president Donald Trump and a new Democratic presidential nominee heightened political uncertainty.

MARKET RECAP

Stock markets hit record highs during the middle of the month. The S&P 500 climbed to a record high on July 16th of 5,667. Volatility then spiked and the S&P 500 fell 8.5% since that high (through 8/5/2024). For the full month, the S&P 500 returned 1.2% and remains up a solid 16.7% on the year.

A weaker dollar, particularly against the Japanese yen, helped developed international equities outperform. The MSCI EAFE gained 2.9% in dollar terms and 0.8% in local currency. The yen appreciated nearly 7% versus the U.S. dollar during July. Emerging-markets stocks trailed with a return of 0.3%. Weakness in Chinese equities persisted in July.

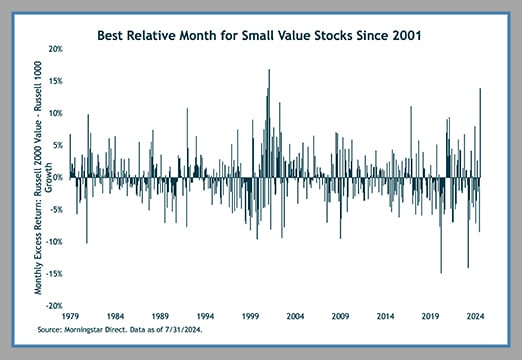

The headline-grabbing market event in July had to do with the rotation out of US mega-cap growth stocks into cheaper, smaller-cap stocks. As a proxy for the rotation, the Russell 1000 Growth Index fell 1.7% compared to the Russell 2000 Value Index that gained 12.2%. It was the 3rd best relative month for small-cap value stocks versus large-cap growth stocks since the index inception in 1979, and best since the tech bubble bust of the early 2000s.

Nine of 11 sectors within the S&P 500 were positive in the month. Only the communication services (down 4%) and technology (down 2.1%) sectors were in the red. However, these two sectors make up over 40% of the S&P 500 and have had a disproportionate impact on index returns in recent years.

The 10-Year U.S. Treasury bond yield continued to fall during the month as investors look forward to September rate cuts. Yields also dropped later in July as investors worried that economic data was softening faster than expected and that a recession may be on the horizon. The 10-Year rate closed the month at 4.09% but fell further towards 3.8% in the early days of August. Falling rates help core bonds post their third straight positive month. The Bloomberg US Aggregate Bond index gained 2.3% in July.

MARKET VOLATILITY

Corrections are normal, and the recent volatility seems to us to be quite a strong reaction to one month of data. We have been observing a lot of volatility this year following the release of economic data points. Recall that at the beginning of the year, the Fed Funds market anticipated up to seven rate cuts, then went to almost no cuts, and now is expecting a rate at least 100 basis points lower at the end of 2024 with a close to 100% probability of a 50 basis point cut in September. We expect there will be more ups and downs in the main financial parameters in the coming months as the market attempts to forecast the outcome.

The current take on the recent volatility is that we have not yet seen sufficient evidence to shift our view of the economy, but we continue to keep a close eye on economic data, and for opportunities that present themselves in the market.

For discretionary use by investment professionals. Portions of this document are provided by iM Global Partner Fund Management, LLC (“iMGPFM”) for informational purposes only and no statement is to be construed as a solicitation or offer to buy or sell a security, or the rendering of personalized investment advice. There is no agreement or understanding that iMGPFM will provide individual advice to any investor or advisory client in receipt of this document. Certain information constitutes “forward-looking statements” and due to various risks and uncertainties actual events or results may differ from those projected. Some information contained in this report may be derived from sources that we believe to be reliable; however, we do not guarantee the accuracy or timeliness of such information. Investing involves risk, including the potential loss of principal. Any reference to a market index is included for illustrative purposes only, as an index is not a security in which an investment can be made. Indexes are unmanaged vehicles that do not account for the deduction of fees and expenses generally associated with investable products. A list of all recommendations made by iMGPFM within the immediately preceding one year is available upon request at no charge. For additional information about iMGPFM, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website (adviserinfo.sec.gov) and may otherwise be made available upon written request.

Certain material in this work is proprietary to and copyrighted by iM Global Partner Fund Management, LLC and is used by OJM Group with permission. Reproduction or distribution of this material is prohibited and all rights are reserved.

For informational purposes only. OJM Group, LLC is an investment adviser registered under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply any level of skill or training. For more information about OJM Group please visit https://adviserinfo.sec.gov or contact us at 877-656-4362. Not intended as legal or investment advice or a recommendation of any particular security or strategy. Information prepared from third-party sources is believed to be reliable though its accuracy is not guaranteed. Investing involves risk and possible loss of principal capital. Past performance is not indicative of future results.