Concerns around a trade war between the U.S. and China took center stage again last month, as a sudden breakdown in trade talks and escalating tariffs and threats between the two countries rattled markets. U.S. stocks fell more than 6 percent in May. The risk-averse environment boosted Treasury bond prices and sunk yields—the 10-year Treasury yield dropped from 2.51 percent to 2.14 percent by month end. The Treasury curve inverted again during May (10-year yield minus 3-month yield) and remained so for the second half of the month, raising (and reflecting) renewed fears of a potential recession on the horizon.

This recap is a stark contrast to last month’s market update. As a reminder, the first four months of 2019 marked the best start for U.S. stocks in 30 years. Even after May’s sharp decline, the S&P 500 was still up over 10 percent for the year. But it is a good reminder that market headlines are often never as good or bad as they seem. Uncertainty is a constant presence and volatility can return to markets at the drop of a tweet. If you own stocks, you need to be prepared to ride through their drops. It’s the shorter-term price you pay to earn their higher expected returns over the longer term.

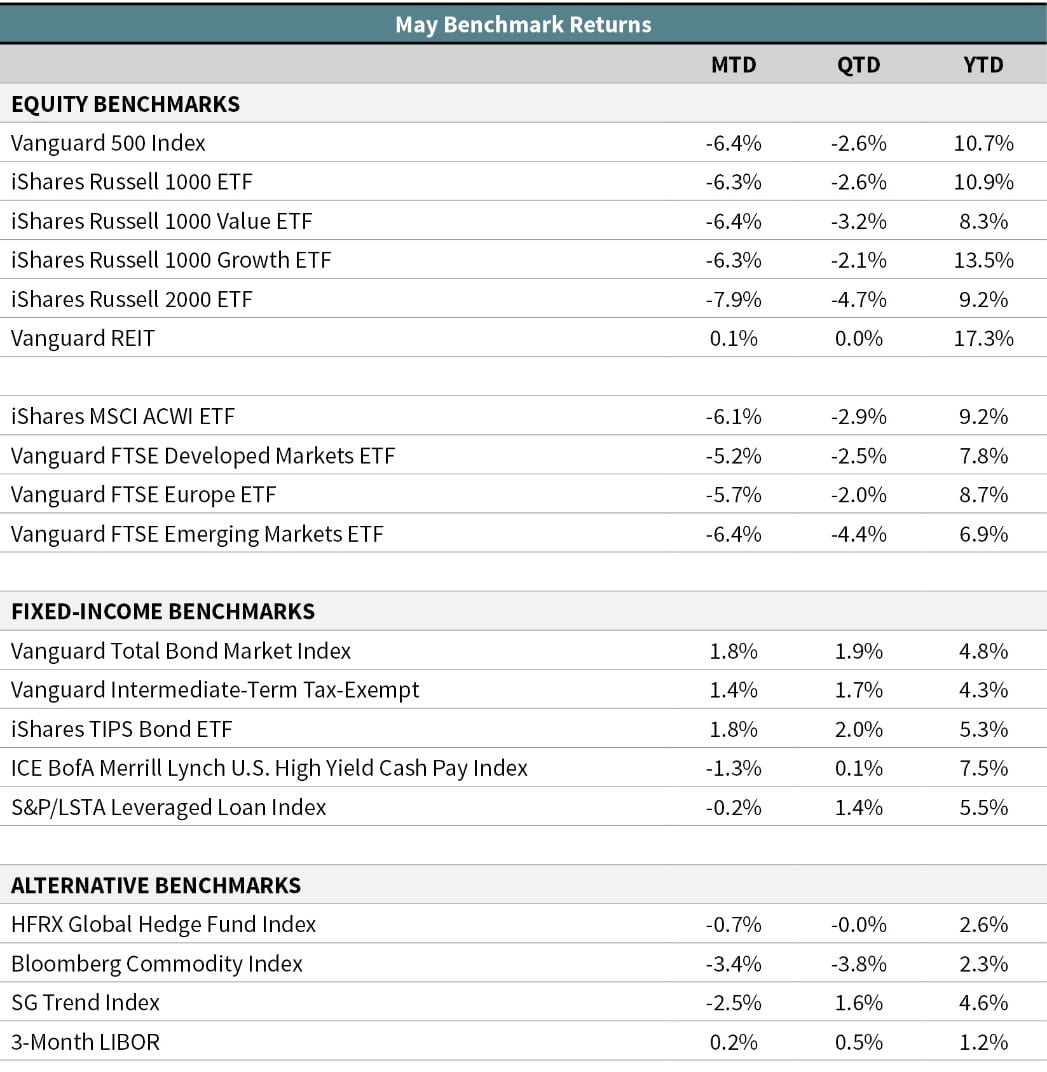

Foreign equity markets also fell in May. Emerging-market stocks dropped a similar amount as U.S. large-cap stocks (the Vanguard FTSE Emerging Markets ETF was down 6.4 percent). Developed international stocks were down slightly less. Vanguard FTSE Developed Markets ETF lost 5.2 percent. European stocks (Vanguard FTSE Europe ETF) dropped 5.7 percent in May.

Bond markets held up during the month, providing beneficial diversification relative to stocks in balanced portfolios. The flight to safety lifted high-quality bond prices, with the U.S. core bond index gaining 1.8 percent in May. More credit-sensitive areas of the fixed-income markets fell modestly: floating-rate loans dipped 0.2 percent and high-yield bonds dropped 1.3 percent.

While the Federal Reserve continues to signal a “patient” monetary policy stance, the fed funds futures market is strongly predicting the Fed will cut rates this year. One month ago, the fed futures market was putting roughly a 50 percent probability that the Fed would cut rates at least once this year. By the end of May, the probability had jumped to 98 percent of at least one cut, and a greater than 80 percent probability of two or more cuts.

The abrupt U-turn in U.S.-China relations, which goes beyond just trade disputes, as well as new tariff threats against Mexico, Europe, and others, has increased the shorter-term risk of a global growth slowdown and a U.S. recession. The financial markets reflected this increased likelihood in May. But this outcome is by no means a certainty. Looking out over the next 12 months, there is still a reasonable “global recovery” scenario, in which we would expect a reversal of May’s performance trends. Over the past 10 years, we have seen the dramatic impact that government and central bank policy can have on the financial markets—sometimes changing the market narrative on a dime. These narratives can then become self-fulfilling, feeding on themselves both on the upside and the downside.

Throughout the year, we have been actively revisiting and re-assessing our risk exposures and return expectations across a range of shorter-term (12-month) and medium-term (5-10 year) scenarios. As always, there are multiple risk and return trade-offs to consider and weigh within the context of each portfolio’s overall risk objective. This includes stress-testing our portfolios for a severe recessionary bear market, an event we think is unfortunately likely within the next five years given the weakness and late stage of the economic cycle coupled with very high valuations for U.S. stocks. We are in the final stages of risk re-assessment. Our analysis is inclining us toward incrementally increasing our shorter-term downside protection in our portfolios. There are a variety of ways we could implement this strategy (again, each involving different trade-offs, depending on the scenario). We expect to complete this work over the next few weeks and will begin to implement the changes if necessary.

- OJM Group Investment Team (6/6/19)