Market Recap

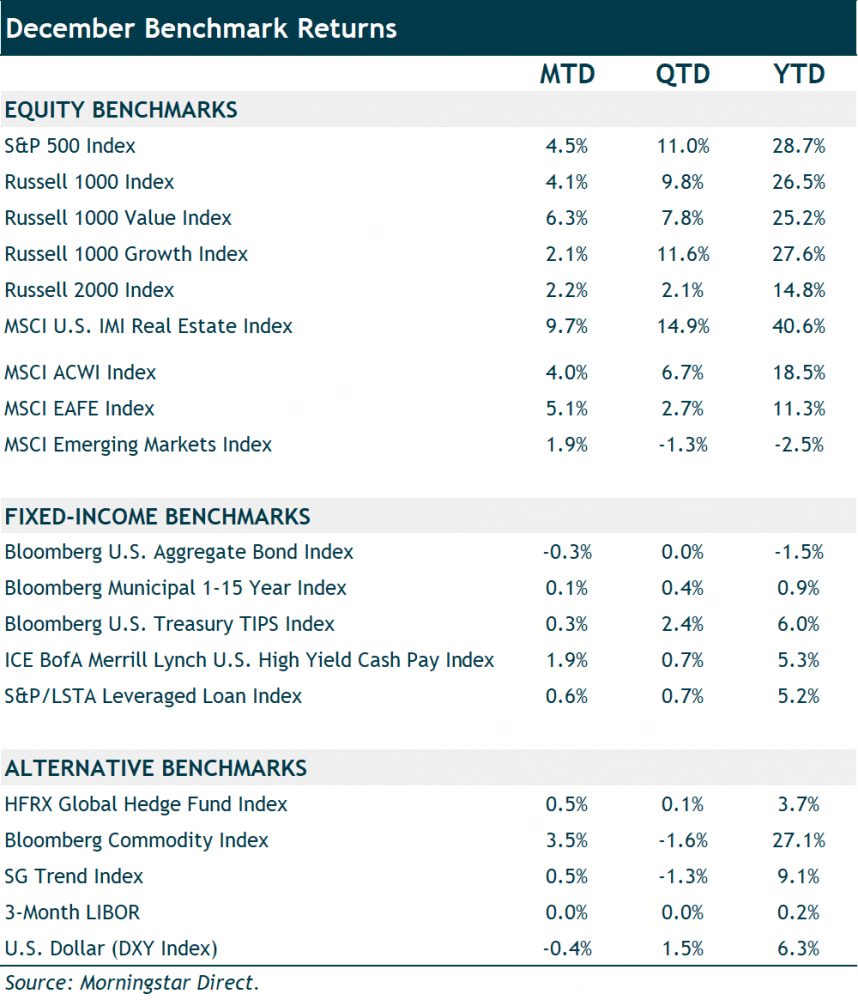

It’s been another solid year for the markets in general. In terms of the various indices, the S&P 500 returned 28.7%, the Russell 2000 Index up 14.8%, developed international stocks (MSCI EAFE Index) up 11.3% and emerging-market stocks (MSCI EM Index) down 2.5% for the year. Much of this outperformance occurred in the fourth quarter, with the S&P 500 gaining 11.0%, compared to 2.1%, 2.7, and -1.3% for small caps, developed international stocks, and EM stocks, respectively.

A strong dollar, the renewed surge in COVID-19 infections late in the year (particularly in Europe and emerging markets), and China’s policy-induced economic slowdown and stock market decline drove the disparity of returns.

Turning to the bond markets, the core bond index (Bloomberg US Aggregate Bond Index) lost 1.5% for the year, as interest rates rose moderately. The benchmark 10-year Treasury bond yield ended the year at 1.51%, compared to a 0.92% yield at the end of 2020. Given the very sharp rise in inflation, most pundits would not likely have predicted such a mild increase in bond yields.

Credit markets fared much better than core bonds in 2021. The U.S. high-yield bond index returned 5.4% (ICE BofA ML High Yield Cash Pay Index) and the floating-rate loan index gained 5.2% (S&P/LSTA Leveraged Loan Index). These returns were consistent with our expectations for a recovering and growing economy.

Portfolio Update

For 2021, our model portfolios generated solid absolute performance. U.S. equities served as the clear catalyst for our portfolios, particularly large-cap U.S. stocks.

Our tactical positions in flexible, actively managed bond funds and inflation-protected bonds added significant additional returns over the core bond index. Our marketable (liquid) alternative positions in managed futures and long/short equity alternatives also significantly outperformed core bonds and added beneficial portfolio diversification but trailed the soaring U.S. stock market.

The main detractor from our portfolio performance was our foreign equity exposure. After outperforming early in the year, the EM stock index suffered from China’s regulatory crackdown/property–market deleveraging, rising inflation, and tightening monetary policy across EM countries. European equities finished the year with strong absolute returns and outperformed EM; however, they trailed the U.S. experiencing a greater economic impact from the renewed surge in the pandemic. The decision to reduce foreign equity exposure in 2020 to fund U.S stocks, paid dividends a year later.

Our 2022 Outlook is Cautiously Optimistic

Our base-case scenario is that the pandemic recedes (but doesn’t disappear), the global economy slows but still grows above trend, corporate earnings growth slows but is still solid, the U.S. rate of inflation remains elevated but is falling, and U.S. interest rates rise moderately.

That would be a positive scenario for the economy and global equity and credit markets, although not for the core bond market. While not our base case scenario, if we were to see a sharply inflationary environment it would undoubtedly be damaging for both stocks and bonds, as interest rates rise, and equity market valuations fall.

All these considerations (and more) factor into our analysis and current tactical portfolio positioning. We would benefit from the base case, but our portfolios are also strategically balanced and well-diversified. We believe they would be resilient should a shock outside our base case occur.

Overall, our balanced portfolios are positioned with an overweight to flexible bonds funds, core positions in lower-risk and diversifying alternative strategies, and a large underweight to long-duration bonds.

Our fixed-income positioning reflects the poor return outlook for the core bond index. Our active, flexible fixed-income managers have a strong likelihood, in our view, of outperforming the index without taking excessive risk. We still maintain a meaningful core bond allocation in our more conservative balanced portfolios as a risk mitigator in the event of a recessionary scenario, which would hurt flexible, credit-oriented bond funds as well as stocks.

Finally, our allocations to marketable alternatives are largely a substitute for some fixed-income exposure. We believe these positions offer better return prospects plus beneficial diversification across a range of scenarios beyond a traditional recession where core bonds shine.

As always, we welcome questions you may have about the investment landscape or your portfolio.