BROADER MARKET STRENGTH FUELS EARLY 2025 GAINS

FEBRUARY 2025 MARKET UPDATE

MARKET OVERVIEW

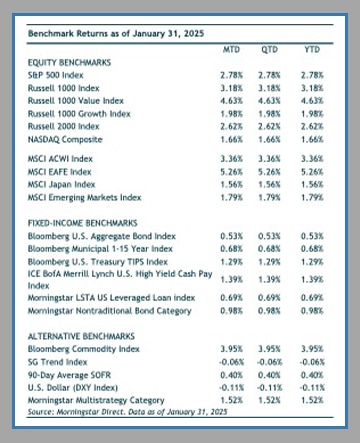

After a strong 2024, the U.S. stock market kicked off 2025 in rocky fashion but ended higher with a gain of 2.8% (S&P 500) in January. Headlines from Washington dominated the month as President Trump’s talk of trade wars weighed on sentiment. But animal spirits, optimism around deregulation, corporate buybacks, and a bit of reprieve on interest rates were enough to push the market higher.

Against this backdrop, the market saw greater breadth with the equal-weighted S&P outperforming the cap-weighted index by nearly 70 basis points. In other words, stocks outside of the mega-cap Magnificent 7 drove returns. Despite the equal-weight outperformance, the S&P 500 reached new record highs during the month. Small-cap stocks (Russell 2000 Index) gained 2.6% in January, recovering some of its 8%-plus decline they suffered in December. Overseas, developed foreign stocks (MSCI EAFE) outperformed the U.S., rising 5.3% in the month. Emerging markets stocks rose 1.8% (MSCI EM).

Within fixed-income, U.S. core bonds were up in January, with the Bloomberg U.S. Aggregate Bond Index rising 0.5%. Rates were volatile in the month but the 10-year Treasury ended the month where it started. As was the case for most of 2024, high-yield bonds outperformed in January, gaining 1.4%.

Economic Background

Regarding the Fed, there were no changes to interest rates at the January meeting, with rates remaining at 4.25-4.50%. As of early February, the market continues to anticipate one to two rate cuts over the remainder of the year. Fed Chair Powell said the Fed is not in a hurry to change monetary policy, particularly as there is uncertainty around the timing and magnitude of potential tariffs.

The imposition of tariffs would be a significant development that introduces uncertainties for global trade, the U.S. economy, and financial markets. While headlines will create volatility, we keep in mind that Trump is motivated by transactions and negotiations. He understands the advantageous position the U.S. is in when it comes to trade, and may use this as leverage, so negotiations could take many forms with varying results. In fact, on the day that tariffs were expected to go into effect (February 4th), tariffs directed toward Mexico and Canada were delayed one month following negotiations with both countries.

Looking ahead, tariffs that do get imposed could have far-reaching effects, particularly on inflation, corporate earnings, and global trade dynamics. A key date we are watching is April 1st, which is the deadline Trump has given for research to be completed on trade and trade deficits. We will continue to closely monitor the situation for further developments.

The narrative around AI stocks faced pressure in January, as China’s low-cost AI model, DeepSeek, triggered a short-term sell-off. The idea that AI could be implemented at a fraction of the cost led to questions about the high level of U.S. tech spending on their AI models, U.S. leadership in the AI space, and worries about rich valuations. The initial shock pushed the stock prices of many AI leaders lower (NVIDIA fell nearly 17% in a single trading session, wiping out around $600 billion in market value), but it appears as though the reported cost savings DeepSeek reported were overblown. We have also seen announcements from President Trump that he intends to ensure the U.S. remains the global leader in AI.

Economic Data

December’s core CPI came in slightly behind consensus (3.2% vs. 3.3%), while headline inflation, which includes more volatile food and energy sectors, was in line with estimates (2.9%). The lower Core CPI reading was welcomed after four straight monthly readings of 3.3%. Core CPI had not decelerated since July 2024.

The labor market remained healthy, as there were 256,000 jobs added versus consensus estimates between 150k-160k in December. The Labor Department also reported the unemployment rate ticked down to 4.1%. The data largely confirmed market expectations that the Fed would pause its rate-cutting cycle at its late January meeting. On February 7th, nonfarm payrolls for January were released—showing a moderation from the previous month. January nonfarm payrolls came in at 143,000 with the unemployment rate falling slightly to 4%.

The Bureau of Economic Analysis released data showing the U.S. economy expanded at a solid 2.8% rate in 2024. The growth rate was underpinned by solid consumer spending, which makes up a large share of the US economy.

Conclusion

January 2025 highlighted the market’s resilience amid political and economic uncertainties. While concerns over trade policies and AI competition caused volatility, strong economic data, corporate buybacks, and steady interest rates provided support. The broader market participation beyond mega-cap stocks and the rebound in small caps suggest investor confidence remains intact. However, the potential impact of tariffs, inflation trends, and the Federal Reserve’s policy decisions will be key factors shaping the market’s trajectory in the coming months. As we move forward, staying attentive to global trade developments and economic indicators will be crucial for navigating the evolving investment landscape.

For discretionary use by investment professionals. Portions of this document are provided by iM Global Partner Fund Management, LLC (“iMGPFM”) for informational purposes only and no statement is to be construed as a solicitation or offer to buy or sell a security, or the rendering of personalized investment advice. There is no agreement or understanding that iMGPFM will provide individual advice to any investor or advisory client in receipt of this document. Certain information constitutes “forward-looking statements” and due to various risks and uncertainties actual events or results may differ from those projected. Some information contained in this report may be derived from sources that we believe to be reliable; however, we do not guarantee the accuracy or timeliness of such information. Investing involves risk, including the potential loss of principal. Any reference to a market index is included for illustrative purposes only, as an index is not a security in which an investment can be made. Indexes are unmanaged vehicles that do not account for the deduction of fees and expenses generally associated with investable products. A list of all recommendations made by iMGPFM within the immediately preceding one year is available upon request at no charge. For additional information about iMGPFM, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website (adviserinfo.sec.gov) and may otherwise be made available upon written request.

Certain material in this work is proprietary to and copyrighted by iM Global Partner Fund Management, LLC and is used by OJM Group with permission. Reproduction or distribution of this material is prohibited and all rights are reserved.

For informational purposes only. OJM Group, LLC is an investment adviser registered under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply any level of skill or training. For more information about OJM Group please visit https://adviserinfo.sec.gov or contact us at 877-656-4362. Not intended as legal or investment advice or a recommendation of any particular security or strategy. Information prepared from third-party sources is believed to be reliable though its accuracy is not guaranteed. Investing involves risk and possible loss of principal capital. Past performance is not indicative of future results.