July’s biggest news item came on the last day of the month. On July 31, Fed Chair Jerome Powell announced the first cut in the federal funds rate since 2008. The Fed

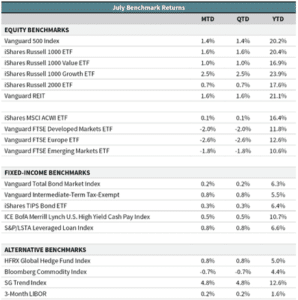

Domestic stock markets were relatively calm throughout July. The last day of the month was the only trading day during which the S&P 500 index moved more than 1 percent in either direction. U.S. larger-cap stocks finished the month up 1.4 percent, while smaller-cap stocks gained 0.7 percent. Year-to-date returns remain impressive: The Vanguard 500 Index is up 20.2 percent and the iShares Russell 2000 ETF is up 16.9 percent.

International equity markets did not fare as well as their U.S. counterparts. Emerging-market stocks fell 1.8 percent in July (Vanguard FTSE Emerging Markets ETF). Developed international stocks (Vanguard FTSE Developed Markets ETF) dropped 2.0 percent last month, while European stocks fell 2.6 percent (Vanguard FTSE Europe ETF). After failing to deliver on her Brexit plans, Theresa May resigned as UK prime minister and made way for another Conservative leader to lead Brexit negotiations. After taking office in July, the new prime minister Boris Johnson has until the October 31 deadline to negotiate the terms of the country’s withdrawal from the European Union.

The Treasury curve remained inverted throughout the month (10-year yield minus 3-month yield), as it has been since May. As global interest rates continued to fall, bond markets inched up 0.2 percent during July. This brings the U.S. core bond index (Vanguard Total Bond Market Index) year-to-date return to an impressive 6.3 percent. U.S. high-yield performed well last month (ICE BofAMerrill Lynch U.S. High Yield Cash Pay Index was up 0.5 percent) and are up double-digits so far in 2019. Floating-rate loans gained 0.8 percent in July and are up 6.6 percent year-to-date (S&P/LSTA Leveraged Loan Index).

Trade tensions escalated last week as China devalued its currency, and the U.S. responded by labeling China a currency manipulator. 10-year Treasury yields fell 12 basis points to a level of 1.74%. Since their peak in November 2018, 10-year U.S. Treasury yields have fallen 150 bps; this has been driven not only by slower global growth, lower inflation expectations, and a dovish Fed, but also by escalating U.S.–China trade tensions. With low rates around the world, fixed income investors need to be more tactical in their investment approach. Given their high correlation to the equity markets, we are reducing our high yield and emerging market fixed income exposures in favor of treasuries. This tactical change is designed as a hedge for a potential global equity sell-off.

—OJM Group Investment Team (8/5/19)