A YEAR OF RESILIENCE AMID CHALLENGES | JANUARY 2025 MARKET COMMENTARY

MARKET OVERVIEW

Our January market update will serve as a 2024 market recap as we review how the U.S. economy and the stock market proved much stronger than many had anticipated in 2024. There are always reasons for worry and in 2024 some of the largest concerns included geopolitical tensions, elevated valuations, stubborn inflation, interest-rate uncertainty, slowing growth in major foreign economies, and of course, the U.S. presidential election. Undoubtedly, investors will have plenty to watch for in 2025. Front and center will be the Trump administration’s policies, which will likely have ripple effects both here in the U.S. and abroad.

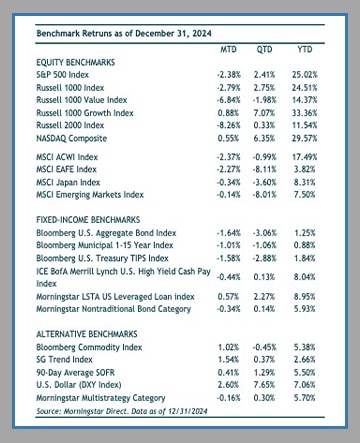

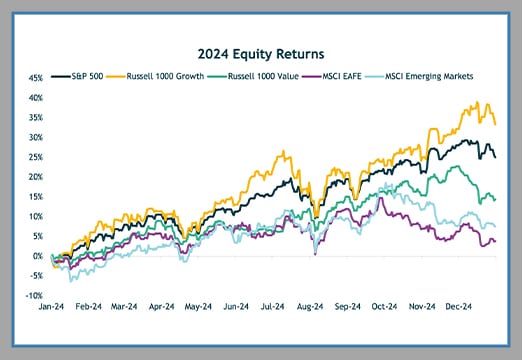

For the year, domestic stocks delivered strong returns with meaningful disparity across the market. Large-cap stocks (S&P 500 Index) posted a gain of 25%, widely outperforming small-cap stocks (Russell 2000 Index), which rose 11.5%. Growth-oriented stocks (Russell 1000 Growth Index) led by technology names, particularly NVIDIA, were the biggest winners, posting a 33.4% gain.

Value-oriented stocks (Russell 1000 Value Index) were up 14.4% in comparison. The equal-weighted S&P 500 Index, where each of the 500 companies accounts for the same percentage of the total index, returned 13%. The equal-weighted index failed to capture the outsized gains made by largest and fast-growing firms in the index.

Continuing our 2024 market recap we head overseas where returns were not nearly as strong. Developed international stocks (MSCI EAFE) posted a modest 3.8% gain. Calendar-year returns for most foreign markets were dragged down by fourth-quarter losses following the Trump presidential victory, which sparked fears of a widespread economic slowdown due to tariff risks and a stronger U.S. dollar. Emerging markets stocks (MSCI EM Index) had a volatile year, finishing the year up 7.5%. Much of that volatility can be attributed to China. The Chinese stock market (MSCI China Index) had a strong year (up 19.4%) but it was tumultuous, marked by significant swings in investor sentiment. Early-year optimism over government stimulus efforts and reopening momentum faded as economic growth fell short of expectations. Then later in the year, the Chinese government jolted the stock market sharply higher with a stimulus package aimed at supporting real estate prices and weakening consumer confidence. Early in the fourth quarter, Chinese stocks were up over 60% off their January lows but ultimately, high debt levels, underwhelming fiscal support, ongoing property market troubles, weak consumption, and international trade pressures weighed on the market.

Within the bond markets, calendar-year returns were mixed across fixed-income segments. The benchmark 10-year Treasury yield experienced significant volatility throughout the year amid concerns around inflation, interest rates, the budget deficit, and the impact of potential tariffs under Trump. After starting the year with a yield of 3.88%, the 10-year Treasury finished the year higher at 4.58%. Against this backdrop, the interest-rate sensitive Bloomberg U.S. Aggregate Bond Index was slightly positive at 1.3%. Conversely, short-term and credit-sensitive sectors of the bond market—both areas we emphasized in portfolios—performed well during the year. The Bloomberg Short-Term Treasury rose 5.3%, and high-yield bonds (ICE BofA Merrill Lynch High Yield Index) were up 8.2% in the year.

For discretionary use by investment professionals. Portions of this document are provided by iM Global Partner Fund Management, LLC (“iMGPFM”) for informational purposes only and no statement is to be construed as a solicitation or offer to buy or sell a security, or the rendering of personalized investment advice. There is no agreement or understanding that iMGPFM will provide individual advice to any investor or advisory client in receipt of this document. Certain information constitutes “forward-looking statements” and due to various risks and uncertainties actual events or results may differ from those projected. Some information contained in this report may be derived from sources that we believe to be reliable; however, we do not guarantee the accuracy or timeliness of such information. Investing involves risk, including the potential loss of principal. Any reference to a market index is included for illustrative purposes only, as an index is not a security in which an investment can be made. Indexes are unmanaged vehicles that do not account for the deduction of fees and expenses generally associated with investable products. A list of all recommendations made by iMGPFM within the immediately preceding one year is available upon request at no charge. For additional information about iMGPFM, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website (adviserinfo.sec.gov) and may otherwise be made available upon written request.

Certain material in this work is proprietary to and copyrighted by iM Global Partner Fund Management, LLC and is used by OJM Group with permission. Reproduction or distribution of this material is prohibited and all rights are reserved.

For informational purposes only. OJM Group, LLC is an investment adviser registered under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply any level of skill or training. For more information about OJM Group please visit https://adviserinfo.sec.gov/ or contact us at 877-656-4362. Not intended as legal or investment advice or a recommendation of any particular security or strategy. Information prepared from third-party sources is believed to be reliable though its accuracy is not guaranteed. Investing involves risk and possible loss of principal capital. Past performance is not indicative of future results.

Index Disclosure: An index is an unmanaged portfolio of specific securities, the performance of which is often used as a benchmark in judging the relative performance of certain asset classes. Investors cannot invest directly in an index. An index does not charge management fees or brokerage expenses, and no such fees or expenses were deducted from the performance shown. Index returns shown are price returns, which exclude dividends and other earnings.