January Investment Commentary

Across the board, it was an extremely difficult year to make money in the financial markets.

U.S. and global stocks dropped sharply in the last quarter, capping a year marked by turbulence and losses across most asset classes. Among investors’ worries are signs of a global economic slowdown, exacerbated by ongoing Federal Reserve monetary tightening, U.S.-China trade tensions, and political uncertainties in Europe (Brexit, Italy) and the United States.

After tumbling 7% in October and then stabilizing in November, U.S. stocks fell again in December as investors reacted negatively to the Fed’s language surrounding its 25-basis-point rate hike (Vanguard 500). While the Fed’s updated forecast implied one fewer rate hike in 2019 than previously communicated (two instead of three), Fed chair Jerome Powell gave no indication it would ease up on its balance sheet reduction program (rolling off hundreds of billions of maturing assets purchased during quantitative easing), nor that a pause in rate hikes was imminent (although he didn’t rule it out). As one commentator summed it up: “This was a more dovish Fed, but not dovish enough for the markets.”

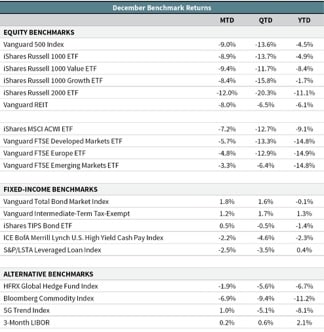

Larger-cap U.S. stocks dropped 9% in December and fell 13.6% for the quarter (its worst quarter in seven years). For the year, U.S. stocks were down a more modest 4.5%. The negative year broke the S&P 500’s remarkable nine-year run of positive returns. Smaller-cap U.S. stocks fell more sharply, losing 20% in the fourth quarter and 11% for the year (iShares Russell 2000 ETF). Foreign stocks struggled as well, with developed international markets and emerging markets both down 14.8% (Vanguard FTSE Developed Markets ETF and Vanguard FTSE Emerging Markets ETF). However, their underperformance versus U.S. stocks came earlier in the year. In the fourth quarter, emerging-market (EM) stocks beat U.S. stocks by seven percentage points, while developed international stocks matched the U.S. market’s return.

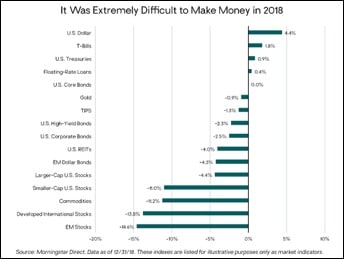

In addition to the equity market declines, what stands out about 2018 is the breadth of negative returns across almost every type of asset class and financial market, whether bonds, equities, or commodities. (And don’t forget cryptocurrencies: Bitcoin plunged 72% for the year.) A study done by Deutsche Bank in mid-November noted that 90% of the 70 different asset classes they track were posting negative returns for the year. This was the highest percentage of losers in the study’s 100-year history. Our chart below shows the year’s performance of sixteen different asset classes.

Core bonds, which typically perform well when stocks do poorly, had losses through November (Vanguard Total Bond Market Index). But a strong rally in Treasury bonds in December resulted in a flat return for the year. Only the U.S. dollar index and U.S. Treasury Bills (T-Bills) had a return above 1%. And after adjusting for inflation, T-Bills’ real return was negative as well.

Simply put, it was extremely difficult to make money in the financial markets last year.

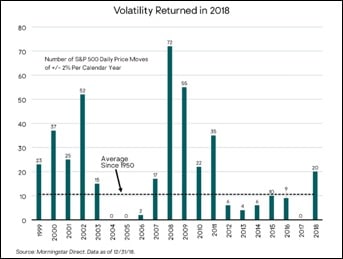

The contrast with 2017’s strong market results is also striking—and serves as a useful reminder of the unpredictability of markets. It may feel like ancient history, but it was only a year ago that we were reporting 25% to 30%-plus returns for international and EM stocks. U.S. stocks were tallying 20%-plus gains, market volatility was at a historical low, daily market price swings were exceptionally muted, and losses were few.

Most investment strategists expected 2018 would bring a continuation of the synchronized global economic recovery. The sharp market pullbacks this year were contrary to the 2017 year-end consensus (just as 2017’s unusually strong returns were a surprise after a difficult 2016) and only reinforce our view that no one can consistently predict short-term market moves.

It also reinforces the importance of maintaining a balanced and contrarian perspective: when an outlook becomes the overwhelming consensus view, you should assume it is already reflected to a strong degree in current financial market prices. Extremely high (or extremely low) asset prices and valuations are already discounting extremely optimistic (or extremely pessimistic) outcomes. Those circumstances can create opportunities for fundamental, valuation-driven, long-term investors such as ourselves and many of the active managers with whom we invest.

Closing Thoughts

Successful investing is a process of consistently making sound, well-reasoned decisions over time, and across market and economic cycles. We believe our diversified, fundamental, valuation-based investment approach meets this definition.

The last year had its share of challenging times, but periods of volatility, negative returns, economic downturns, and geopolitical chaos are inevitable and, in the end, create the opportunities that allow fundamental strategies to work. When we do transition to an environment where fundamentals and valuations matter, and the distortions we’ve experienced during this market cycle fade to the background, it will be a rewarding time to be a globally diversified investor again. We remain confident in the pillars of a globally diversified portfolio and acknowledge that market volatility could remain in place.