At year-end, many consider donations to charities but are not quite sure of the best way to do so tax-wise. In this article, we will address one tool that can be quite effective in achieving two-fold benefits: the charitable remainder trust.

Two-Fold Benefits of Charitable Donations

Properly done, charitable planning can create a win-win scenario—a gift to a worthy cause and tax benefits for the donor and his/her family. In fact, with some techniques, like the one we will describe below, there can even be a third “win”—the creation of an income stream for the donor’s family.

The Charitable Remainder Trust

Let’s assume you have a charity to which you would like to donate. You also have a highly appreciated asset you wish to sell but are reluctant to do so because of the significant capital gains taxes you would owe. Furthermore, you do not want your heirs to pay estate taxes on this asset (or others because of the total value of your estate). At the same time, you would like to reduce your current year’s taxable income and receive an ongoing income stream. In this situation, the Charitable Remainder Trust (CRT) may be an ideal option for you.

Used properly, a CRT can potentially:

- Reduce current income taxes with a sizable income tax deduction

- Eliminate immediate capital gains taxes on the sale of appreciated assets, such as stocks, bonds, real estate and just about any other asset

- Increase your disposable income throughout the remainder of your

- Create a significant charitable gift

- Reduce estate taxes that your estate might have to pay upon your death, thus leaving more for your heirs

- Avoid probate and maximize the assets your family will receive after your

- Protect your highly appreciated property from future

Think of a CRT as a tax-exempt trust that provides benefits to two different parties. The two different parties are the individual(s) receiving income and the chosen charity or charities. The “income beneficiaries” (usually you or your family members) typically receive income from the trust for either their lifetimes or a specified number of years (20 years or less). At the end of the trust term, the chosen charity will receive the remaining principal to utilize for its charitable purposes.

How A CRT Works

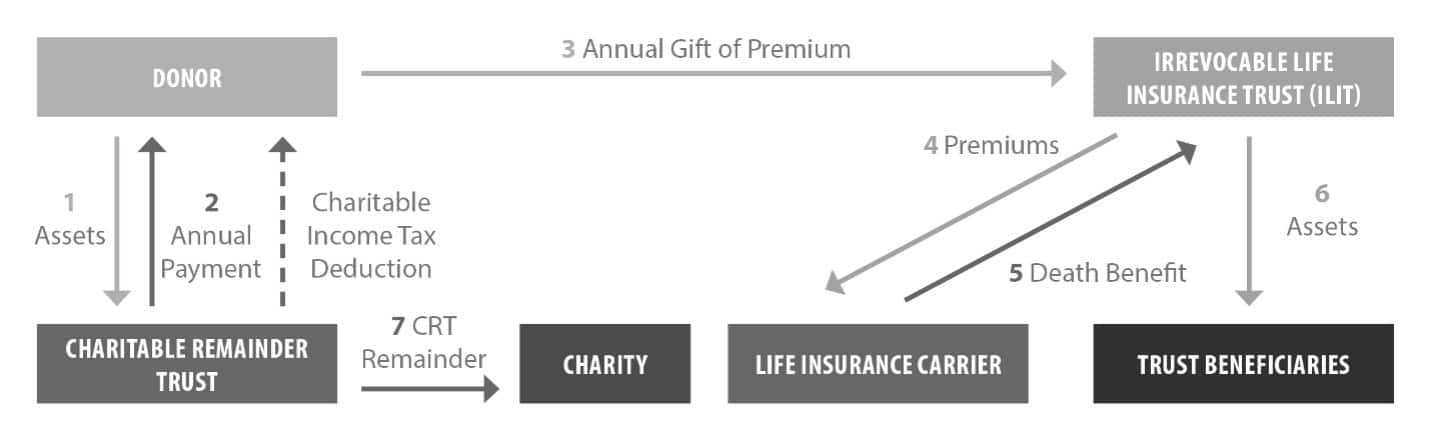

A CRT is an irrevocable trust that makes annual or more frequent payments to you, typically until you die. What remains in the trust then passes to a qualified charity of your choice.

Several tax-saving advantages may flow from the CRT. First, you will obtain a current income tax deduction for the value of the charity’s interest in the trust. The deduction is permitted when the trust is created even though the charity may have to wait until your death to receive anything. Second, the CRT is a vehicle that can enhance your investment return. Because the CRT pays no income taxes, the CRT can generally sell an appreciated asset without recognizing any gain or paying any tax on the sale. This enables the trustee to reinvest the full amount of the proceeds from a sale and thus generate larger payments to you for the rest of your life.

Using Life Insurance For “Wealth Replacement”

Many high-net-worth individuals might be motivated to make gifts to charities, but they are afraid that they won’t leave an adequate inheritance to their heirs. Those with charitable intentions should understand that they can make donations during their lifetimes, save income taxes, and find a way to leverage the tax deduction to achieve a similar, or sometimes larger, inheritance for their heirs. This is the concept of using life insurance for wealth replacement.

A CRT is eligible for the estate tax deduction if it passes assets to one or more qualified charities at the time of one’s death. If you wish to replace the value of the contributed property for heirs who might otherwise have received it, you could use some of your cash savings from the charitable income tax deduction to purchase a life insurance policy on your life held in an irrevocable life insurance trust for the benefit of your heirs. This is called a wealth replacement trust.

Often, through the leveraging effect of life insurance, it is possible to pass on assets of greater value than those contributed to the trust. In this way, your heirs are not deprived of property they had expected to inherit. In fact, your heirs may find it advantageous to receive cash, in the form of proceeds from a death benefit, as opposed to an asset that they do not want or know how to manage.

Let’s see how this works:

- You gift a highly appreciated asset to the CRT and receive a current income tax deduction that you can use to reduce your income tax liability for up to five

- The CRT sells the Neither you nor the CRT pays any taxes on the sale. The total value of the asset is preserved and invested in a tax-free environment.

- You receive a larger annual distribution from the CRT than you would have received if you had paid taxes on the sale of the asset and invested the proceeds in a taxable situation.

- Although the annual distribution is taxable, it is taxed in accordance with how it was earned in the This form of taxation is beneficial given the lower dividend and capital gains tax rates. The income beneficiary could save a significant amount in taxes each year.

- After the death of all income beneficiaries, the remaining assets from the CRT go to your selected charity.

- A wealth replacement trust can be funded with insurance to replace those assets given to charity and give the family even more than they would have received had no charitable planning been

Conclusion

This article briefly explains charitable and estate planning strategies which require certain expertise to maximize their benefits. We encourage you to work with experienced advisors to evaluate whether these tactics and tools may make sense in your planning. The authors invite your inquiries.