Saving money at an early age is perhaps the simplest and one of the most effective methods to accumulate wealth. While working hard and earning a healthy income can certainly place physicians on a path to successful retirement, the world’s most successful investors understand how to make their money work on their behalf.

Buying a medical practice, surgery center, ancillary business, or a group of rental properties are examples of how you can potentially make your money work for you. Implementing these strategies can be sound to diversify wealth, however they involve illiquid assets and require significant capital and/or substantial debt. Consequently, these options may not be realistic for a physician right out of residency, or for any young professional. Owning and managing these assets can also demand a considerable time commitment. This begs the question: how can you begin making your money work for you at an early age, and is the strategy superior to saving aggressively in higher earning years as you approach retirement?

Investing in the stock market requires only a modest amount of capital and a small monthly commitment. Automatic investment programs require little time to implement, and investing for doctors and physicians allows you to take advantage of compounding.

Albert Einstein once noted that the most powerful force in the universe was that of compounding. Much like a snowball that increases in size as it rolls down a mountain, a compounding asset gains steam with each passing year as you begin to earn interest income on your interest income. The result is your wealth growing at an ever-accelerating rate.

What Determines Compound Interest?

In simple terms, three factors determine how your money will compound: the interest rate you earn on your investments (rate of return), the time horizon and your tax rate.

Case Study: Saving Early Makes a Big Difference

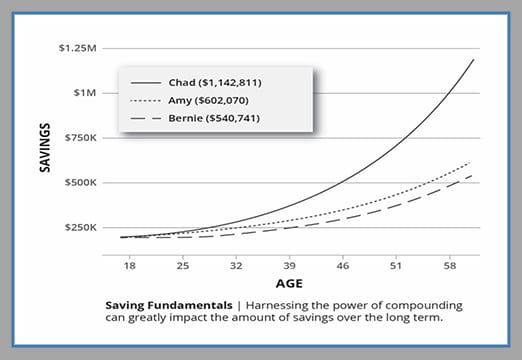

Amy, Bernie, and Chad enjoy the same 7% annual investment return on their retirement funds. The only difference is when and how often they save:

- Amy invests $5,000 per year beginning at age 18. At age 28, she stops. She has invested $50,000 over 10 years.

- Bernie invests the same $5,000 per year but begins where Amy left off. He begins investing at age 28 and continues until he retires at age 58. Bernie has invested $150,000 over 30 years.

- Chad is our most diligent saver. He invests $5,000 per year beginning at age 18 and continues investing until retirement at age 58. He has invested $200,000 over 40 years.

Bernie has invested three times as much as Amy, yet Amy’s account has a higher value. She saved for just 10 years while Bernie saved for 30 years. This is the power of compound interest: the investment return that Amy earned in her ten early years of saving is the key—its impact is so significant that Bernie could not catch up, even though he saved for an additional 20 years. The best retirement saver is obviously Chad, who began saving early and never stopped. Note that he saved much more than either Amy or Bernie.

It is clear from the case study that compound interest favors those who start saving early.

Compared to people in other careers, physicians can be behind the eight ball when it comes to saving because medical training is long, and physicians earn lower incomes during residency and fellowship. Young physicians, including residents and fellows, should take note that investing even a small amount early on in your 20s and 30s helps you achieve your financial goals faster than most other things you will do during your medical career.

Physician Examples: Starting to Save Later

Even if you are an established physician or other professional who is getting a late start in the retirement saving process because of military training, a late entrance into your career, or even a financial setback or divorce, the lesson remains the same: NOW is the time to begin saving.

Consider the following examples with larger dollar amounts that may reflect the potential savings rate of a physician. In each example, we will assume the physician is investing in mostly equities and earning 8% per year. An 8% annual average return allows an investor to essentially double their money in nine years.

- A doctor starting at age 30 with $50,000 would double their money by age 39, would have $200,00 by age 48, and $400k by age 57.

- What if the investor added $50,00 each year for 9 years?

- $674,328 by age 39, $1,348,656 by age 48, and $2,697,312 by age 57

- How about $50,000 yearly for 18 years?

- $2,022,313 at age 48, and $4,142,563 by age 57

- If $50,000 was saved every year through age 57?

- $4,716,941 by age 57

In the final example above, the hypothetical investor is earning several hundred thousand dollars per year in their fifties. Stock market returns of course are neither linear nor guaranteed. This example illustrates both the benefit of starting early and the power of compounding over time. When combined with consistent savings, the combination of these three approaches allows a physician to accumulate substantial wealth.

What are the challenges to starting early?

Physicians may face multiple financial challenges post-training, despite earning a healthy income. You may graduate with medical school debt, plan to get married, have children and intend to buy a home. Many of your short-term goals may be occurring simultaneously. After years of school and training, a desire to reward yourself is very reasonable. A certain degree of lifestyle creep is also inevitable and will be an impediment to savings. Balancing wants, needs, and goals will be a challenge and there is no “one size fits all” approach. Your situation is certainly going to be unique.

Simple Steps to Take Now

The most important step you can take is to set a savings goal. Occasionally investors find it easier to work backwards when creating a budget. Establishing a savings goal can help you create a budget and define priorities. Regardless of your approach, it will be necessary to determine fixed expenses, and then determine reasonable discretionary expenses.

An initial home purchase can complicate a savings plan if the full financial implications are not carefully considered. The true cost of ownership should be understood, which extends beyond principal and interest mortgage payments. Maintenance and upkeep are frequently underestimated expenses (utilities, property taxes, landscaping are examples). The first home does not necessarily have to be a dream home.

Recognizing the difference between luxury and extravagance will also help you reach your savings goals. Physicians typically find themselves in the top 1-2% of all earners, meaning they are in a position where they may not need to count every dollar spent. Successful financial planning is more about limiting excess, rather than counting nickels.

Conclusion

Starting to save early means not having to sacrifice in your later years. Good savings habits when at the outset of your career may be the difference that allows you to retire early and experience financial freedom when you are still young enough to enjoy it. A professional planner can help you determine where to save to reach your goals and prioritize savings early in your career.