From HIPAA liability to malpractice claims, physicians have unique challenges to juggle. Added to factors like student loan debt, the costs of starting out, and ongoing expenses like liability insurance, these obstacles get expensive.

The good news is that, as a doctor, your salary is among the top for professionals globally. And just as you’d tell your patients that prevention is the best way to stay healthy, you can use preventative care to protect your assets from those risks.

What does asset protection for doctors look like? Chances are, you’ve already started this path with a malpractice insurance policy.

Yet, taking care of your finances as a doctor goes well beyond the basics. Here, we’ll share the essential steps experts recommend as physician asset protection must-haves.

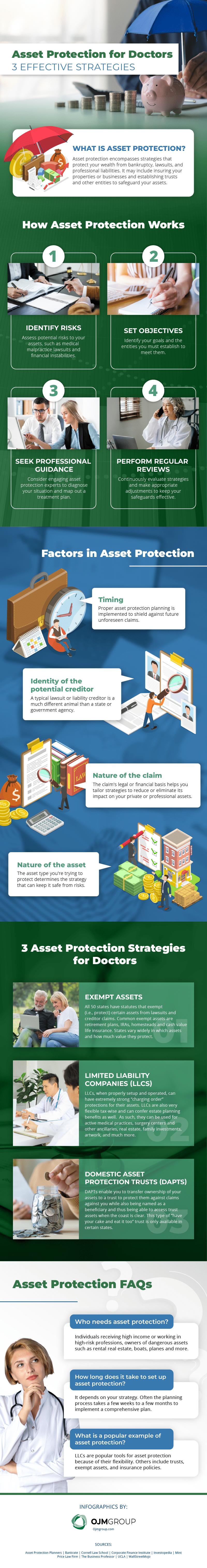

What is Asset Protection?

Asset protection involves implementing legal and financial planning strategies to safeguard wealth from risks, including bankruptcy, legal conflicts, and professional liabilities. It protects your hard-earned assets to lessen the impact of these events on your financial stability, enabling you to survive threats to assets.

How Asset Protection Works

There are numerous legal and financial strategies involved in asset protection. As such, the specific steps to guarding your wealth vary depending on your approach. In many cases, they coincide with wealth planning tactics for doctors and physicians and develop in the following process.

1. Identify Risks to Your Assets

Start by conducting a thorough assessment of potential risks to your assets. As a doctor, some liabilities you may face are malpractice lawsuits, employee claims, HIPAA violations, slip and falls from real estate, auto accidents, and more.

2. Set Objectives

Do you want to protect specific assets, minimize tax obligations, or safeguard wealth for your heirs?

3. Seek Professional Guidance

Consider getting help from experienced professionals specializing in asset protection and wealth management. They eliminate guesswork and guide you through developing a protection plan tailored to your needs. Professionals also create guides, such as asset protection through investing for doctors and physicians.

4. Perform Regular Reviews of Your Assets

It is important to evaluate and adjust your strategies occasionally to keep them updated on changes in the law. Legal structures often require some annual maintenance of formalities as well.

Factors in Asset Protection

Asset protection is a multi-faceted approach involving the following factors to determine an appropriate strategy.

1. Timing

The best time to create an asset protection plan is when there are no looming creditors that can take away your assets. There are laws against moving assets once a liability becomes “reasonably foreseeable”, such as the Uniform Fraudulent Transfer Act. These rules are why asset protection is a “planning” strategy that prepares for potential liabilities.

2. Identity of the Potential Creditor

Certain creditors may also have more power than others, making protections less effective. Government agencies are an example of such.

Creditors fall into the following classes, depending on the strategies applicable to them:

- Unsecured creditors: They don’t have a claim against any specific asset. Establishing trusts or LLCs and leveraging exemptions can protect your wealth against their claims.

- Secured creditors: They have claims against particular assets you’ve placed as collateral. Some strategies you may implement are negotiations for favorable terms and restructuring debts.

3. Nature of the Claim

What’s the legal or financial basis on which the creditor is trying to access your assets? Understanding the nature of their claim can help you tailor holistic strategies to your specific needs.

4. Nature of the Asset

Finally, your strategies depend on the types of assets needing protection. Some may have an exemption associated with them already, making protection easier. For others, legal tools will be required.

Malpractice Insurance

When you’re in the medical field, you know malpractice insurance is vital to your job. But what does your policy cover, and are you as protected as you think?

This professional liability insurance protects the policyholder from damages incurred by patients or their representatives, who may file a malpractice suit for complaints of harm.

Malpractice lawsuits include negligent care (unintentional damage), as well as intentionally harmful medical choices that result in harm to or the death of a patient.

Why You Need to Know What Your Coverage Includes (and Excludes)

Why is this coverage such a big deal in the healthcare industry?

Studies show that tens of thousands of preventable deaths occur every year in hospitals and medical facilities.

Note that the claim of medical negligence as the third leading cause of death in America is now highly contested. Still, even one preventable death is too many, and these numbers have healthcare providers, patients, and insurers on guard against claims of negligence.

This type of insurance is offered through private insurance companies, employers, medical risk retention groups, or other organizations. Policyholders can include claims-made or occurrence options.

Malpractice premiums range depending on your risk level. Factors that determine the annual cost of coverage include:

- Amount of coverage

- Type of policy (claims-made versus occurrence)

- History of previous claims

- Your specialty

- Practice location (facility, hospital, etc.)

- Your hours on the job

- Size of your staff

But rather than shopping for the lowest-priced coverage — which can be tempting with insurance often in the thousands-of-dollars-per-month range and rising—healthcare providers need policies that cover them in the event of a claim, whether recently or years ago.

Read our related article on Protecting Against Malpractice Liability

What If Somebody Sues Me?

Unfounded or not, malpractice claims include expenses for legal costs, medical damages, and — in some cases — punitive damages.

These expenses add up, but your malpractice insurance ensures you don’t need to pay for them as long as the costs don’t exceed your policy limits (see our section on umbrella coverage) and the claim meets the policy’s criteria.

If someone sues you, the coverage question becomes whether you had claims-made or occurrence malpractice insurance.

Claims-made coverage only works if your policy’s effective date was active when the treatment in question took place. Occurrence insurance handles claims of treatment made when the policy was in effect, even if it is no longer active.

When switching employers or malpractice insurance, there may be a gap in claims-made coverage. Obtaining tail insurance provides the peace of mind of knowing that any incidents reported after a policy was canceled will still be covered.

However, since the onset of widespread use of alternative dispute resolution (ADR) strategies, healthcare providers have a potential buffer between a claim and litigation in malpractice lawsuits.

Alternative Dispute Resolution (ADR)

ADR is a strategy that involves negotiation, mediation, and arbitration. It became a federally-accepted procedure with the Administrative Dispute Resolution Act of 1996.

As techniques have evolved over the years, ADR has been successfully used to reduce the expenses and delays of traditional litigation in malpractice cases.

ADR refers to procedures in which both parties involved in the claim agree to use a neutral party to assist them in reaching an agreement to the terms, thereby avoiding litigation. These services may include:

- Mediation

- Arbitration

- Negotiation

- Minitrials

- Neutral fact-finding

Through ADR, the parties agree to voluntarily work toward a consensual agreement, skipping the need for a judge or jury’s decision.

Strategies in ADR focus on communication between both parties and the creative discussions of potential solutions. With ADR involved, statistics show a 50-67% reduction in litigation and a substantial decrease in the amount of damages per claim. Through mediation, 75-90% fewer litigation cases occur, with a $50,000 per claim cost savings. Overall, plaintiffs and defendants report 90% satisfaction using ADR.

Your malpractice provider and financial advisor can help ensure you qualify for and have this protection.

Umbrella Insurance

Umbrella insurance is not just for a rainy day. It provides an extra layer of liability coverage protection to the rest of your insurance policies (excluding malpractice).

Most insurance policy limits won’t be enough to protect your assets. For a small premium, umbrella coverage fills the gap between any claims and your policy limits.

As one of the least expensive types of asset protection coverage, umbrella insurance is a smart way to increase your financial security. However, it’s often overlooked and underused.

Consider a type of worst-case scenario where you’re dealing with a liability lawsuit stemming from an auto accident. The final numbers are in, and the expenses and damages total more than your policy limits. The overage is your responsibility — unless you have umbrella insurance.

This inexpensive policy can be stacked to increase your other insurance coverage, including auto, renters, and homeowners (with limits), etc. No matter what unexpected claim you face, you have a significant buffer between your personal assets and the settlement costs.

Why Physicians Need It

Since it’s well-known that healthcare providers have a high income and asset threshold, someone could target you specifically for lawsuits. An umbrella policy increases your protection and is suggested for anyone with a net worth or assets worth more than their existing policy limits.

Consider holding a policy that covers your net worth and asset value, and reassess these numbers regularly.

Umbrella policies are almost as essential as malpractice and general liability coverage for healthcare providers. As inexpensive as the policies typically are, this small addition to your asset protection plan is easy to justify, as the expense may be significantly outweighed by the peace of mind it provides.

Legal Entities

The first tool that physicians often consider beyond insurance, especially for their practice, is a legal entity like a corporation or Limited Liability Company (LLC). Before understanding how these entities differ, we must examine both “inside risks” and “outside risks.”

“Inside risks” are those which threaten the practice and its assets from the inside. These are the practice faces because of its activity.

Examples of inside risks would be lawsuits against the practice by its:

- Customers for product liability

- Patients for malpractice

- Employees for wrongful termination

No business entity can shield the practice from such inside claims. The only way to protect the practice from inside claims is to protect its assets and cash flow from potential practice creditors. (This is where the insurances described above play a crucial role.)

“Outside risks,” on the other hand, are potential claims against the owner(s)’ interests in the practice itself. For example, an outside claim might be a successful car accident lawsuit against the owner of the practice, where the plaintiff now wants to get to the practice’s assets to satisfy the judgment.

An LLC is superior to a corporation for outside risks because corporation stock is vulnerable to outside claims. In other words, a plaintiff with a successful lawsuit against the owner of a corporation can come after that corporate stock. Even worse, depending on the ownership percentage, by taking the stock, they may be able to gain access to all of the corporation’s assets.

However (as discussed in our books), LLC ownership interests are not in such a vulnerable position to outside claims, if properly structured and maintained.

LLCs are generally shielded by the charging order rules and do not allow such a level of vulnerability to outside claims as do corporations. This is why attorneys typically recommend LLCs over corporations today for closely held businesses and real estate.

While a corporation is generally not recommended, with a medical practice, this is not much of a concern since local law may only allow a licensed physician (in that specialty) to own a medical practice.

Thus, in most cases, a non-doctor cannot even own the corporation stock, even if they were awarded it in a lawsuit. Also, it would be worthless to them regardless, as you could open a competing practice the next day in a new entity. Therefore, we generally do not think that using a professional corporation is an inferior plan.

OJM has two podcasts featuring asset protection experts. Give them a listen: Career Transitions, Asset Protection & Podcasting and Expert Insights on Asset Protection

Exempt Assets: From Homestead to Life Insurance, Qualified Plans and IRAs to Annuities

For protecting personal assets, physicians often initially turn to “exempt” assets, since they are shielded at the highest level under the law.

Federally Exempt Assets

Federally exempt assets are those protected under federal bankruptcy law. Federal law protects certain assets from creditors and lawsuits if the defendant is willing to file bankruptcy to eliminate the creditor. In a Chapter 7 bankruptcy, the debtor will be able to keep any assets that federal law deems exempt.

The two significant asset classes that federal law protects are qualified retirement plans (QRPs) and individual retirement accounts (IRAs). A “qualified” retirement plan complies with certain Department of Labor and Internal Revenue Service rules. For the protection to apply, the plan should also abide by the Employee Retirement Income Security Act (ERISA).

One might know QRPs by their specific type, including:

- Profit-sharing plans

- Money purchase plans

- 401(k)s

- 403(b)s

Although there are several technical differences, IRAs are similar to these plans and are also given exempt status under federal law.

While the protection for QRPs and IRAs is (+5), it only applies if one is in bankruptcy and has access to the federal exemptions.

The amount of value in the QRP or IRA that would be protected outside of bankruptcy — as with an ordinary lawsuit and creditor action — is governed by your state law. Fortunately, every state provides its own exemptions as well.

State Exempt Assets

State exemption leveraging is a fundamental part of wealth planning that every doctor should take seriously. The most significant state exemptions are the following:

- QRPs and IRAs

- Primary residence (or homestead)

- Life insurance and annuities

Important note: We will make general comments regarding state exemptions below. They are not meant to be accurate for any particular state.

Qualified Retirement Plans & IRAs

Nearly all states have significant (+5) exemptions for QRPs and IRAs. Some states protect only a certain amount or protect QRPs more significantly than they do IRAs. A physician must understand the exemptions for retirement plan assets in his or her state and build wealth accordingly.

Primary Residence: Homestead

Many states protect only between $10,000 and $60,000 of the homestead’s equity. Some, such as New Jersey, provide no protection, while others, like Florida and Texas, generally provide unlimited protection (with some restrictions).

Given today’s real estate values and the equity that many physicians have in their homes, it’s clear that most states’ homestead exemptions provide inadequate protection.

Homestead protection is often automatic but may require additional action in some cases.

Each state has specific requirements for claiming homestead status. In some, one must file a declaration of homestead in a public office. Other states set a time requirement for residency before homestead protection is granted. One should never assume that the home is protected, but rather confirm with an advisor knowledgeable with local requirements.

Life Insurance & Annuities

All 50 states have laws that protect varying amounts of life insurance and/or annuities. Check with an experienced advisor on the rules in a particular state.

Some general observations:

- Some states only protect life insurance policies but not annuities, or vice versa.

- Some shield both cash values and death benefit proceeds for both life insurance and annuities, some for one policy/annuity element but not the other.

- Many states shield the entire policy/annuity from the owner’s creditors. Some also protect against the beneficiary’s creditors.

- Many states protect the policy proceeds only if the policyholder’s spouse, children, or other dependents are the policy beneficiaries.

- Some states protect a policy’s cash surrender value in addition to the policy proceeds. This can be the most valuable exemption opportunity.

Quasi-Exemption: Tenancy by the Entirety

Tenancy by the entirety (TBE) is not an exempt asset; it is a state-controlled form of joint ownership available to married couples to provide total protection against claims against one spouse.

About 20 states offer TBE, but it sometimes only applies to real estate owned by TBE. In other states, both real and personal property — like investment accounts — can be shielded through TBE.

While TBE can be a cost-effective tool for married physicians in the states where it is available, physicians should be aware of some risks associated with this form of joint ownership:

- Joint claim risk — TBE provides no shield against joint risks, including lawsuits arising from your jointly owned real estate or acts of minor children.

- Divorce risk —If you get divorced before or during a lawsuit, you lose all protections from TBE.

- Survivor risk — If one spouse dies before or during a lawsuit, you lose all protections from TBE.

Trusts

Certainly, trusts can play significant roles in many physicians’ asset protection planning.

The first thing to understand about trusts is that they can be divided into two broad categories: revocable and irrevocable.

Revocable trusts, as their names indicate, can be revoked at any time, like a will. They can always be changed or superseded. Revocable trusts like “family trusts” or “living trusts” can be extremely valuable for estate planning. However, because they can be revoked or changed at any time, they provide no asset protection against lawsuits or liability risks, at least as long as the grantor (the person who created the trust) is alive.

Revocable trusts are useless for asset protection precisely because they allow the grantor to undo the trust. In other words, if you wanted to unwind a revocable trust and use the funds for yourself, you could do so.

Therefore, a creditor can essentially force the grantor of the trust to do this – asking a court to “step into the shoes” of the grantor if the grantor owes money to the creditor.

While revocable trusts offer no asset protection, irrevocable trusts are outstanding for asset protection.

Once one establishes an irrevocable trust, they forever abandon the ability to undo the trust and reclaim property transferred to the trust. With an irrevocable trust, the grantor loses both control of the trust assets and ownership.

Domestic Asset Protection Trusts (DAPTs)

For many years, a person in the U.S. who was interested in creating an irrevocable trust to protect assets against their potential future creditors — but also wanted access to those same assets — would need to establish a trust outside the U.S. (as no state allowed this type of trust).

These types of trusts were called Asset Protection Trusts or Offshore Asset Protection Trusts.

This all changed in 1999, when the first state – Alaska — changed its laws to allow them. Thus was born the category of Domestic Asset Protection Trust (DAPT). As of this writing, 20 states have now adopted statutes that authorize DAPTs in their state.

As mentioned above, DAPTs are unique irrevocable trusts in that an orthopedist can be both the settlor establishing the trust and a beneficiary. When there is no lawsuit concern, the doctor can access the trust assets as a beneficiary.

But, if they ever have lawsuit concerns, the trust can be written so that the trustee cannot make distributions to the orthopedist, as they are “under duress.”

In this way, a DAPT can allow access to the trust assets when the “coast is clear” and protection when lawsuits and creditors are lurking. With these ideal qualities, DAPTSs can be very attractive for physicians who live and practice in a state with DAPT trust legislation.

Even for orthopedists in non-DAPT states, they may be able to take advantage of a DAPT in a foreign state if the trust is drafted in a way that complies with their home state law (this is called a “hybrid” DAPT or HDAPT).

A partial list of states with DAPT legislation includes Alaska, South Dakota, Nevada, Ohio, Missouri, Connecticut, and Delaware.

For a complete list, please contact us.

Conclusion

You’ve worked hard to increase your net worth and obtain the assets you’re proud of. It’s time to develop an asset protection plan that keeps them safe!

From insurance coverage to your financial portfolio, this information hub of essential asset protection strategies provides various options to get you started.

When you’re ready to take the next step,

for more information on ensuring your assets are as safe as possible so you can focus on what you do best — caring for the health and well-being of others.

Disclosure:

OJM Group, LLC. (“OJM”) is an SEC registered investment adviser with its principal place of practice in the State of Ohio. SEC registration does not constitute an endorsement of OJM by the SEC nor does it indicate that OJM has attained a particular level of skill or ability. OJM and its representatives are in compliance with the current notice filing and registration requirements imposed upon registered investment advisers by those states in which OJM maintains clients. OJM may only transact practice in those states in which it is registered or qualifies for an exemption or exclusion from registration requirements. For information pertaining to the registration status of OJM, please contact OJM or refer to the Investment Adviser Public Disclosure web site www.adviserinfo.sec.gov.

For additional information about OJM, including fees and services, send for our disclosure brochure as set forth on Form ADV using the contact information herein. Please read the disclosure statement carefully before you invest or send money.

This article contains general information that is not suitable for everyone. The information contained herein should not be construed as personalized legal or tax advice, or as a recommendation of any particular security or strategy. There is no guarantee that the views and opinions expressed in this article will be appropriate for your particular circumstances. Tax law changes frequently, accordingly information presented herein is subject to change without notice. You should seek professional tax and legal advice before implementing any strategy discussed herein.