June 2023 Market Commentary

- The S&P 500 eked out a 0.4% gain despite concerns a deal would not be struck to increase the debt ceiling

- Hype around artificial intelligence sent some growth stocks significantly higher

- Market narrowness has reached historic levels—with only a handful of stocks accounting for all the market index return

- Investors have started to price in a “higher for longer” outlook for interest rates

MARKET RECAP

The old adage of “sell in May and go away” held true for most asset classes. Many indexes produced negative returns in the month. US mega-cap growth equities, however, bucked the trend. The strength of a handful of largest growth stocks resulted in a modestly positive return of 0.4% for the S&P 500 in May, while the Russell 1000 Growth index jumped 4.6%. Meanwhile, the S&P 500 equal-weighted index fell 4.2% for the month.

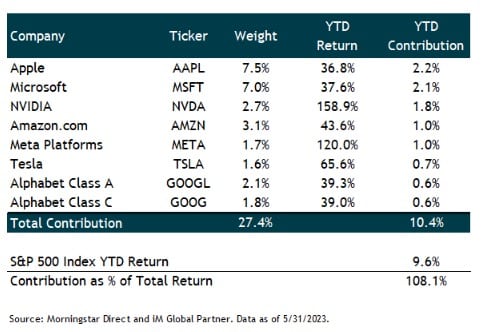

The start to 2023 has been one of the narrowest markets in recent history. Reflecting the narrowness, just seven stocks account for more than 100% of the S&P 500’s year-to-date total return (see table below). These seven companies account for 27% of the S&P 500’s market cap at month-end. Richard Bernstein Advisors recently published a chart showing that only 28% of stocks in the S&P 500 are outperforming the broader index (as of 5/18/2023). Since 2007, the median percentage of stocks that outperform the index in a given calendar year is 48%. The “Magnificent Seven” stocks have carried indexes higher.

The May 2-3 FOMC meeting was the anticipated event throughout much of April. Despite banking stress and inflation double the Fed’s 2% target, it was largely expected that a 25 basis points increase in the fed funds rate was in the works (bringing the target range to 5%-5.25%). The Fed followed through on this, which is now widely expected to be the final rate hike in the current hiking cycle. The CME futures market has it at a 100% certainty that the Fed will cut rates multiple times between now and the end of the year. This is one of the big divides in the market—the Fed and Chair Powell want to hold rates at these levels for an extended period; however, the market is expecting a U-turn in short order.

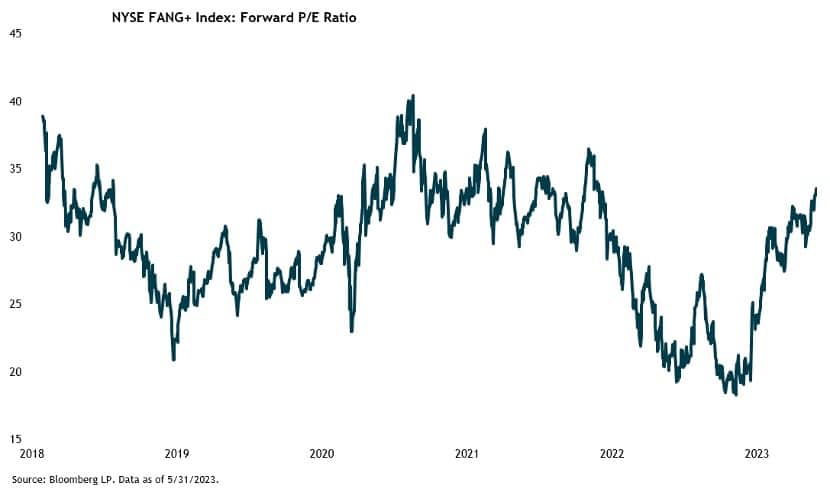

The returns of these mega-cap growth names has been astonishing. The NYSE FANG+ Index—which includes the seven stocks in the table, plus Netflix, Snowflake, and Advanced Micro Devices—has a year-to-date gain of 61%! The advance has pushed the P/E ratio for these names back to where it was in 2020-2021. The forward P/E of this index was cut in half over a two-year period but has now expanded to price the next twelve months of earnings at over 33x. As a comparison, the forward P/E ratio of the S&P 500 stands at 18.6x (which is above its own 40-year average valuation of 15.3x).

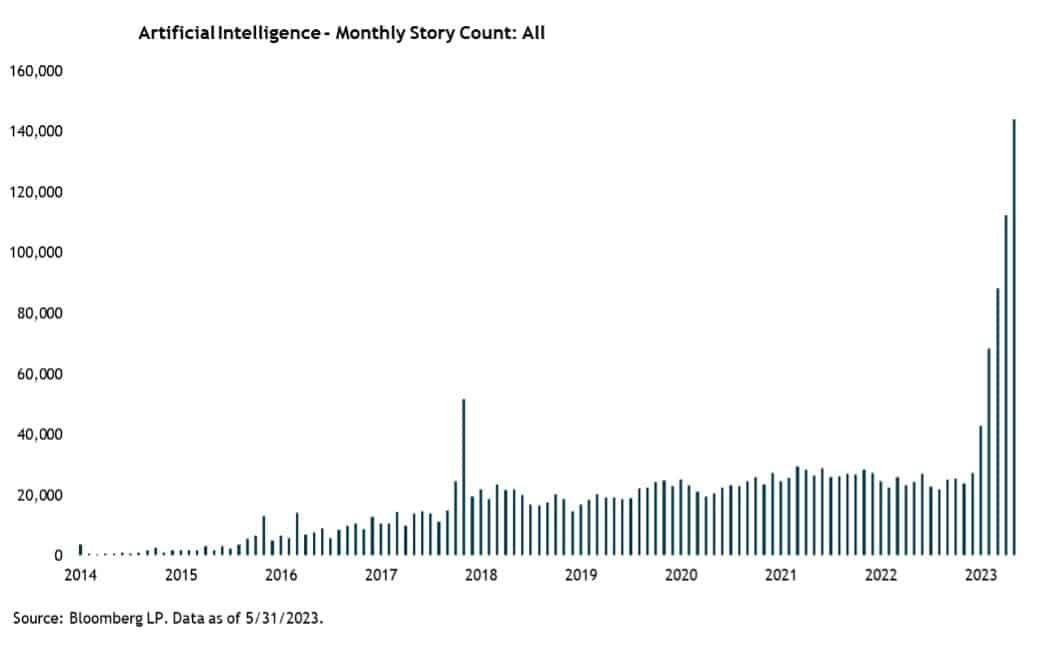

The most impressive gainer this year has been NVIDIA. Thanks to the hype around artificial intelligence, the company has seen its stock rise more 159% this year—even briefly surpassing the $1 trillion market capitalization mark in May. NVIDIA’s graphics processing units (GPUs) are a key component for companies that are building artificial intelligence applications. Since the release of ChatGPT, interest in artificial intelligence has skyrocketed. Artificial intelligence has become the buzzword in recent months.

Equity markets overseas did not fair as well as US markets in May. A strong dollar (up 2.6% in May) was a headwind. Developed international stocks fell 4.2%–largely on the back of a 5.9% decline in Europe. Emerging-market stocks fared better with a drop of 1.7%. Rate hikes continued in Europe during the month—with both the European Central Bank (ECB) and Bank of England (BoE) raising target rates by 25 basis points to 3.25% and 4.5%, respectively. Similar to in the US, eurozone inflation remains well above target. During May, eurozone headline inflation registered at 6.1% (down from 7% the month prior). Core inflation eased to 5.3% in May from 5.6% in April.

In the U.S., interest rates moved higher during the month—particularly on the short-end due to concerns around the debt ceiling standoff. The one-month Treasury bill started the month at 4.35% and spiked as high as 6% towards the end of May before settling at 5.3% once it became clearer that a deal would be reached. The 10-year Treasury rate started the month at 3.44% and ended at 3.64%. The yield curve remains deeply inverted—with short rates meaningfully higher than those at the long end. After two months of gains, the Bloomberg US Aggregate Bond Index fell 1.1% in May. Riskier credit slightly outperformed the core bond index. The ICE BofA US High Yield market fell 0.9%.

INVESTMENT TAKEAWAYS

Many leading indicators on the economy are flashing red, however, the GDP has yet to roll over, puzzling many pundits. That being said, we remain cautious about the market and economy—but with the understanding that markets may go higher in the short-term. We know that predicting a recession is notoriously difficult (as we’ve all seen over the last year). However, we can prepare for where we think we are in the market cycle. Over the last year, interest rates have increased by five percentage points, excess liquidity is being drained from the system, and bank lending has been curtailed—all of which work with varying lags on the economy. While the timing of a downturn is unpredictable, we see the economy as more likely closer to the end of a cycle than the start of a new upswing. Therefore, we continue to believe it prudent to have caution as we wait for opportunities to add to risk assets.