OJM'S PERSPECTIVE

Each time a U.S. presidential election approaches, we revisit our views about its impact on our investment outlook and portfolio positioning. Regardless of their political viewpoints, clients regularly ask us how OJM plans to respond if a specific candidate is elected or re-elected. Our job, as a fiduciary, is to remove any personal bias we may have and to look at the situation objectively. While the specific circumstances of any given election are always unique, our approach remains the same – to put our clients’ interests first.

What does recent history tell us and what can we learn from longer-term historical data?

The two most recent presidential elections serve as a useful history lesson. Former President Barack Obama was running for re-election in 2012. He made it very clear during his campaign that he would be raising the top marginal tax rates, if re-elected. An argument was made that tax increases would send the U.S. economy into a recession as the market sold off in October and early November of 2012. President Obama won re-election, raised taxes as he promised, and the S&P 500 gained 32% in 2013 and nearly 14% in 2014.

Donald Trump ran for president in 2016, promising to challenge our trade partners and assuring voters he would be particularly tough on China (the world’s second largest economy). A case was made that President Trump would impose tariffs, create a trade war, and lead the U.S. economy into a recession. U.S. markets retreated in October of 2016 and began to rally immediately after the election; the S&P increased by nearly 22% in 2017.

Our research has shown that, over a full market cycle, returns are driven by fundamentals, not temporary shifts in investor sentiment, short-term momentum trading, flights to safety, or political rhetoric. Yes, fiscal policy can impact all the above in the long term, and there are important differences in the candidates’ policy stances, but presidents do not get to decide these things in a vacuum. Without knowing which, when or how policy proposals will eventually be enacted, making preemptive changes to portfolios is more likely to hurt than help.

Market Performance Around Elections

Election years have sometimes led to downside volatility for the stock market, especially when incumbents lose. However, markets typically rebound strongly from any declines around elections the following year. This supports our point that, for any investor with a time horizon longer than a year or two, elections do not have a meaningful or long-lasting effect on investment performance. It will generally pay off to look beyond the election at the other drivers of markets and potentially even to take advantage of election-year declines. It is important to note that election and post-election year analyses represent the average result historically, and the sample size is often small. There are many reasons the market could respond differently this year, among them a large amount of economic stimulus, the ongoing pandemic, a quickly rebounding economy, and so on.

Fundamentals Drive Long-Term Investment Outcomes, Regardless of the Party in Power

Instead of betting on election results, we stick to our longer-term analytical framework, in which we consider and weigh multiple macro scenarios, and assess the potential risks and returns for numerous asset classes and investments in each scenario. As investors, we expect to experience market volatility and shorter-term downside risk at times. Stock market history makes this clear. The degree will depend on the portfolio’s risk profile and the corresponding risk exposure. Experiencing volatility is a necessary evil of owning stocks and other higher returning “risk assets.”

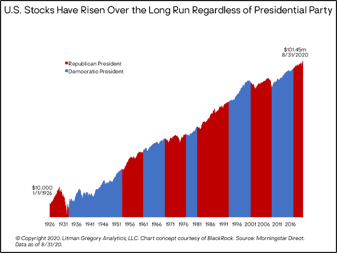

History also shows that the political party in power is not a significant differentiator or driver of investment returns. There are simply too many other factors, variables, and events that impact markets and asset prices over time beyond election outcomes.

Dealing with Uncertainty

How do we deal with uncertainty? Whether election-driven or otherwise, we handle it by not making sudden moves in to or out of the markets based on headlines. Instead, we develop and assess a range of scenarios, then construct diversified portfolios that are positioned to meet our clients’ longer-term goals, while minimizing the impact of temporary market drops.

While elections do matter for several reasons—do not let the results or outside noise persuade you to make sudden moves that could adversely affect your long-term goals. Investing at reasonable valuations, balancing risk against potential reward, and not letting anxiety drive your decisions will likely matter more in the long run. If you are unsure how your specific wealth management plan is built to weather these uncertain times, please contact OJM Group to discuss.