First and foremost, we never try to bet on outcomes. What we try to do, regardless of market or election cycle, is maintain an investment discipline focused on the long term, based on analyzing valuations and fundamentals, that attempts to limit downside risk. Viewed through that lens, here is what we are watching, analyzing, and positioning for:

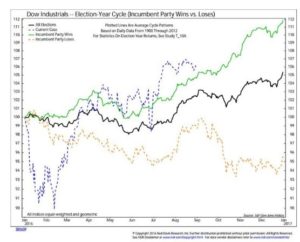

Along with sudden shocks (e.g., terrorist strikes), unexpected developments (such as the Brexit vote results), and lately, central bank actions, presidential elections can certainly drive short-term market swings. But the longer-term impact is a different story. This chart from Ned Davis Research contains data on election cycles from 1900 through 2012. It shows that during presidential election years, financial market swings have tended to be magnified in the final weeks of the campaign. This has been particularly true in years when the incumbent party lost. Once voting was over, markets have generally rallied going into year end.

Economic Fundamentals (Long-term Outlook)

Over a full market cycle, returns are driven by fundamentals, not temporary shifts in investor sentiment, short-term momentum trading, flights to safety, or political rhetoric. While the U.S. economy could hardly be called robust, growth is positive, unemployment is down, and wages are up. Consumer spending is increasing, and confidence recently hit a 12-month high. None of these are likely to change overnight based on what happens in November.

Yes, fiscal policy can impact all of the above fundamentals in the long term, and there are important differences in the candidates’ policy stances, but presidents don’t get to decide these things in a vacuum. Without knowing which, when or how policy proposals will eventually be enacted, making preemptive changes to portfolios is more likely to hurt than help.

Downside Risk

It is unclear how much markets are pricing in current polling data, but the election’s outcome could still turn out to be surprising. Even if market prices accurately reflect the results, how they would react over the short and longer terms is a different story. We are more focused on the impact of U.S. interest rates rising over the next several years. With the Federal Reserve and other central banks’ policies playing outsized roles in recent years—pushing stock prices higher and spurring bond yields to record lows—we see downside risks as they begin to pull back. We have already seen short-term spikes in yields push bond prices down and drive stock market swings in anticipation of rising interest rates. With the S&P 500 currently valued at a historically high earnings multiple (price-to-earnings ratio) that is not supported by strong corporate earnings trends, a rise in U.S. interest rates from their abnormally low levels is just one thing that could put downward pressure on prices.

Dealing with Uncertainty

How do we deal with uncertainty? Whether election driven or otherwise, we handle it by not making sudden moves in or out of markets based on headlines. Instead, we develop and assess a range of scenarios, then construct diversified portfolios that are positioned to meet our clients’ longer-term goals, while minimizing the impact of temporary market falls.

While elections do matter for a number of reasons—do not let the results or outside noise persuade you to making sudden moves that could adversely affect your long-term goals. Investing at reasonable valuations, balancing risk against potential reward, and not letting anxiety drive your decisions will likely matter more in the long run. If you’re unsure how your specific wealth management plan is built to weather these uncertain times—please contact OJM Group to discuss.