U.S. PRESIDENTIAL ELECTION EFFECT ON THE MARKETS, INSIGHTS AND TRENDS | DECEMBER 2024 MARKET COMMENTARY

MARKET OVERVIEW

After questioning the outcome of the U.S. presidential election throughout October, the uncertainty was answered in early November. The market’s early response to the Trump victory was positive, perhaps based on the platforms of less regulation and lower taxes. Of course, questions arose around the economic impact from talks of tariffs and mass deportations. With the republicans taking control of the Senate and the House of Representatives, the likelihood of Trump proposals being enacted was increased.

One topic most seemed to agree on was that regardless of who took office, deficit spending would continue. An estimate from the Committee for a Responsible Federal Budget estimated that national debt would increase by $4 to $8 trillion over the next 10 years.

The concern with an increasing deficit is that it necessitates more debt issuance, which can lead to higher interest rates, resulting in a risk to economic growth. Following the election, there was a turn toward fiscal austerity with the introduction of the advisory commission, the Department of Government Efficiency, which aims to improve the efficiency of the federal government and meaningfully cut government spending.

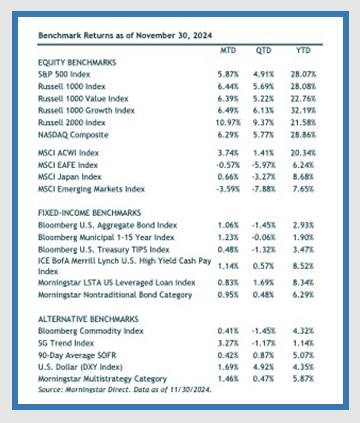

Domestic stocks performed well following the election. The S&P 500 gained 5.9% in the month, bringing its year-to-date return to 28.1%. Small-cap stocks (Russell 2000 Index) seemed to benefit from optimism around economic growth, lower interest rates, and pro-business policies. The day following the election, small-cap stocks rose 5.8%, and for the month, gained nearly 11.0% in November. The tech-heavy Nasdaq gained 6.3%. Foreign developed stocks (MSCI EAFE) fell 0.57% in the month, while the emerging markets (MSCI Emerging Markets) fell 3.6%. International stocks suffered from potential tariffs, a stronger dollar, and heightened Russia-Ukraine tensions. The year-to-date returns for developed foreign stocks and emerging markets stocks are 6.2% and 7.7%, respectively.

Within fixed-income, the markets remained focused on the Fed in November, and the magnitude and timing of interest-rate cuts. The Fed’s 50 basis points cut in September was intended to ensure the strength of the labor market, as the Fed felt confident inflation would reach its target. After a strong first quarter, average new job growth slowed meaningfully through most of the third quarter and unemployment increased from 3.8% to 4.2%. But a strong September jobs report revived some optimism and led the market to question the extent of future rate cuts. This put all eyes on the October results, but hurricanes, a Boeing strike, and a shortened data collection period all blurred the picture of whether the employment backdrop was improving.

Bond yields were volatile in November, which seemed to be driven by the incoming administration and new economic data. As anticipated, the Fed did unanimously decide to cut the Fed Funds rate by 0.25% at the November meeting to a range of 4.5% to 4.75%. The Fed seems confident that their current policies will result in inflation continuing to trend towards their 2% target, while further supporting labor market conditions. As of early December, interest rate futures implied a 70% probability of another 0.25% at the Fed’s mid-December meeting. The current expectation is down from 90% in November, reflecting less certainty of the Fed’s next move. Looking to 2025, many are questioning whether the Fed will slow the pace of cuts from their latest forecast of four 25 basis point cuts, which would bring the Fed Funds rate to a range of 3.25% to 3.50%.

As for inflation, the year-over-year CPI data matched forecasts, coming in at 2.6%, which was up from the prior month’s 2.4% reading. Many jumped to the conclusion that inflation has stalled, and it might not reach the Fed’s target. We would point out that the narrative around inflation has changed a few times this year based on one month of data. We have continued to expect inflation to fluctuate but trend lower.

For discretionary use by investment professionals. Portions of this document are provided by iM Global Partner Fund Management, LLC (“iMGPFM”) for informational purposes only and no statement is to be construed as a solicitation or offer to buy or sell a security, or the rendering of personalized investment advice. There is no agreement or understanding that iMGPFM will provide individual advice to any investor or advisory client in receipt of this document. Certain information constitutes “forward-looking statements” and due to various risks and uncertainties actual events or results may differ from those projected. Some information contained in this report may be derived from sources that we believe to be reliable; however, we do not guarantee the accuracy or timeliness of such information. Investing involves risk, including the potential loss of principal. Any reference to a market index is included for illustrative purposes only, as an index is not a security in which an investment can be made. Indexes are unmanaged vehicles that do not account for the deduction of fees and expenses generally associated with investable products. A list of all recommendations made by iMGPFM within the immediately preceding one year is available upon request at no charge. For additional information about iMGPFM, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website (adviserinfo.sec.gov) and may otherwise be made available upon written request.

Certain material in this work is proprietary to and copyrighted by iM Global Partner Fund Management, LLC and is used by OJM Group with permission. Reproduction or distribution of this material is prohibited and all rights are reserved.

For informational purposes only. OJM Group, LLC is an investment adviser registered under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply any level of skill or training. For more information about OJM Group please visit https://adviserinfo.sec.gov/ or contact us at 877-656-4362. Not intended as legal or investment advice or a recommendation of any particular security or strategy. Information prepared from third-party sources is believed to be reliable though its accuracy is not guaranteed. Investing involves risk and possible loss of principal capital. Past performance is not indicative of future results.

Index Disclosure: An index is an unmanaged portfolio of specific securities, the performance of which is often used as a benchmark in judging the relative performance of certain asset classes. Investors cannot invest directly in an index. An index does not charge management fees or brokerage expenses, and no such fees or expenses were deducted from the performance shown. Index returns shown are price returns, which exclude dividends and other earnings.