SEPTEMBER MARKET UPDATE

THE MONTH AT-A-GLANCE

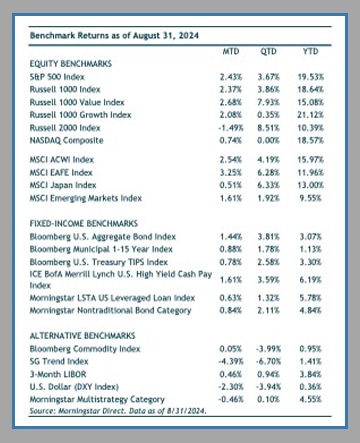

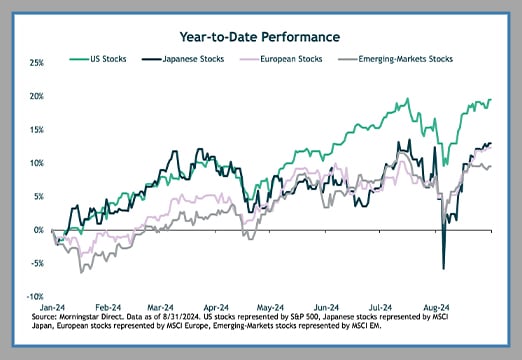

- After heightened downside to start the month, global stocks (as represented by the MSCI ACWI Index) rallied nearly 10% to close out August up 2.5%.

- Within the US, large cap value stocks outpaced growth stocks, but smaller cap stocks lagged.

- At the Fed’s annual Jackson Hole symposium, Fed Chair Powell signaled that policy rates are headed lower starting in September.

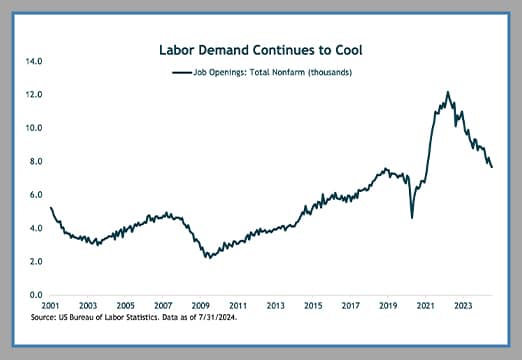

- The Fed’s shift in focus to the labor market has investors dissecting any and all jobs market reports.

MARKET RECAP

A sharp selloff to start August was ignited by disappointing economic data in the US and a hawkish Bank of Japan at the end July resulted in the unwind of the massive USD/JPY carry trade.

However, global stocks quickly recouped those losses and worked their way back close to all-time highs. Despite two modest pullbacks during the year, global stocks continue to grind higher and have positive double-digit returns so far in 2024.

The sell-off in early August was set off by a weaker than expected nonfarm payrolls increase for July. Nonfarm payrolls grew by just 114,000 in July, well short of the expectation of 175,000.

The unemployment rate rose for the fourth straight month to a nearly three-year high at 4.3%. The early August jobs report triggered the Sahm Rule—a widely-followed recession indicator—which further put investors on edge that the economy was slowing faster than expected.

As the rest of August played out, economic data releases signaled a more resilient US economy and that the “soft landing” scenario was still attainable. Second quarter GDP was revised upwards to 3% and the Atlanta Fed’s GDPNow estimate for the third quarter remained above 2% throughout the month. Additionally, July retail sales accelerated at 1%, which was well ahead of the 0.3% estimate—giving credence to a still strong US consumer, the most important driver of the economy.

The Federal Reserve helped risk assets finish higher following the release of the July FOMC meeting minutes and Chair Powell’s Jackson Hole speech that clearly signaled a rate cut at their September meeting. In his speech, Powell said, “the time has come for policy to adjust” and that the Fed “will do everything we can to support a strong labor market.” The Fed is clearly shifting their focus to both sides of their dual mandate (price stability and maximum employment) after spending the last couple years fighting inflation.

The labor market has weakened but has not fallen off a cliff. Job openings continue to normalize at a lower level following significant labor shortages during the pandemic. July’s job openings fell to 7.7 million, which was below the consensus estimate of 8.1 million.

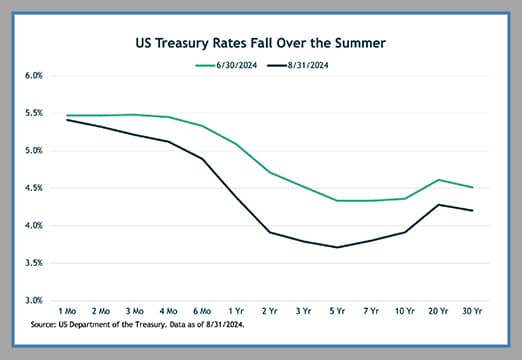

The bond market has largely front-run policy rate cuts. The policy sensitive two-year interest rate fell from 4.71% at the end of June to 3.91% at the end of August. US core bonds (as represented by the Bloomberg U.S. Aggregate Bond Index) posted a solid 1.4% return in August—bringing their return since the start of the quarter to 3.8%. August marked the fourth consecutive month the US core bond index was positive, the longest streak in three years.

The yield curve has moved closer to normalizing. The two-year, 10-year US Treasury spread has turned positive—as the 10-year rate is again above that of the two-year. This section of the yield curve was inverted since the summer of 2022. There are some studies that show recessions typically occur after the inverted curve “uninverts” and not when it first goes into inversion.

Whether or not the economy can skirt a recession will have implications on risk assets. Historically, if the Fed is cutting rates and the economy does not go into a recession, assets can continue to appreciate. However, if Fed cuts precede a recession, asset prices stand to fall in value. Clearly, investors are positioned and expecting the former scenario to play out. Stock indexes are near all-time highs, valuation multiples are stretched, and credit spreads are historically tight.

For discretionary use by investment professionals. Portions of this document are provided by iM Global Partner Fund Management, LLC (“iMGPFM”) for informational purposes only and no statement is to be construed as a solicitation or offer to buy or sell a security, or the rendering of personalized investment advice. There is no agreement or understanding that iMGPFM will provide individual advice to any investor or advisory client in receipt of this document. Certain information constitutes “forward-looking statements” and due to various risks and uncertainties actual events or results may differ from those projected. Some information contained in this report may be derived from sources that we believe to be reliable; however, we do not guarantee the accuracy or timeliness of such information. Investing involves risk, including the potential loss of principal. Any reference to a market index is included for illustrative purposes only, as an index is not a security in which an investment can be made. Indexes are unmanaged vehicles that do not account for the deduction of fees and expenses generally associated with investable products. A list of all recommendations made by iMGPFM within the immediately preceding one year is available upon request at no charge. For additional information about iMGPFM, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website (adviserinfo.sec.gov) and may otherwise be made available upon written request.

Certain material in this work is proprietary to and copyrighted by iM Global Partner Fund Management, LLC and is used by OJM Group with permission. Reproduction or distribution of this material is prohibited and all rights are reserved.

For informational purposes only. OJM Group, LLC is an investment adviser registered under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply any level of skill or training. For more information about OJM Group please visit https://adviserinfo.sec.gov or contact us at 877-656-4362. Not intended as legal or investment advice or a recommendation of any particular security or strategy. Information prepared from third-party sources is believed to be reliable though its accuracy is not guaranteed. Investing involves risk and possible loss of principal capital. Past performance is not indicative of future results.