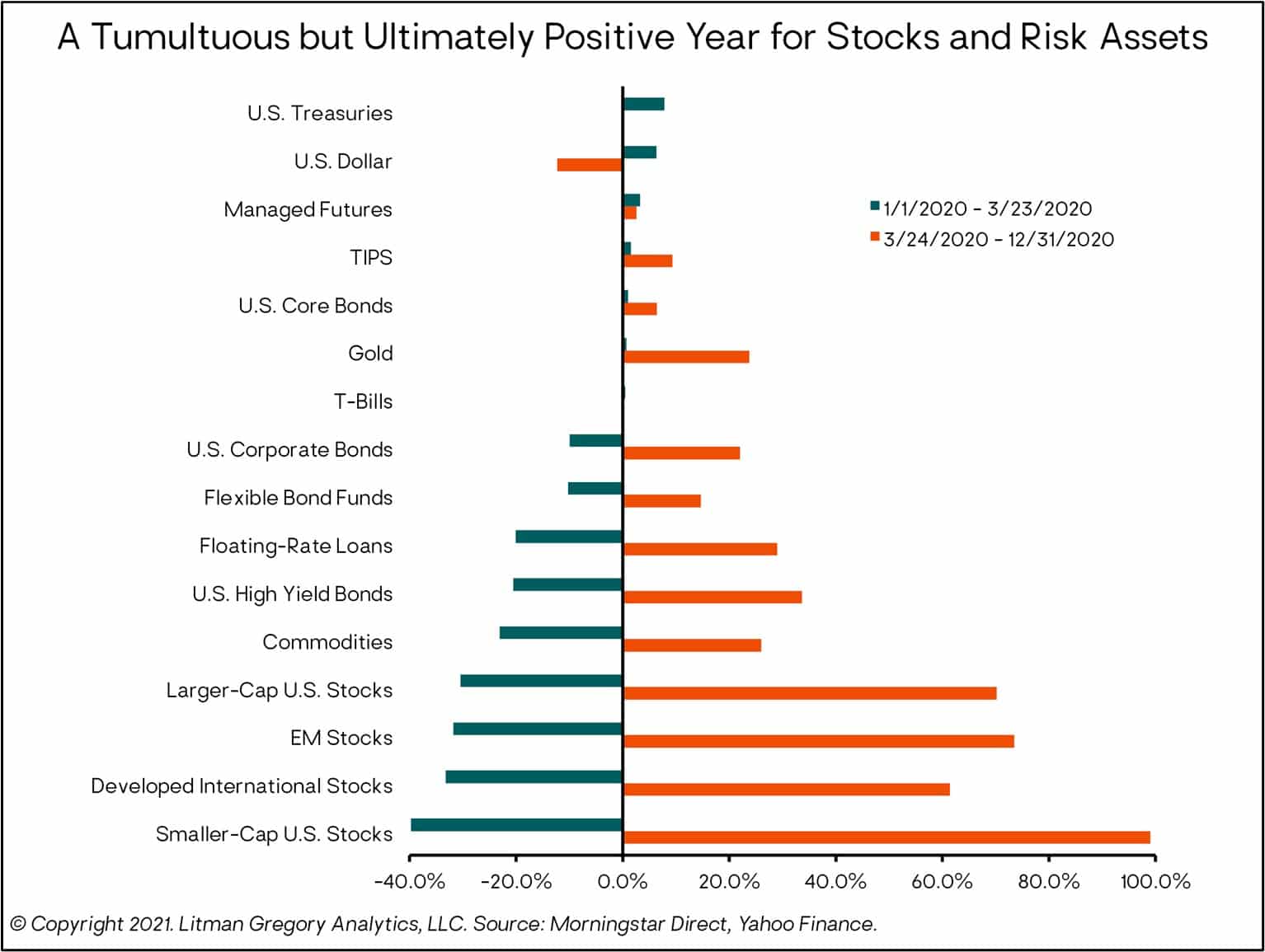

The past year was tragic and turbulent in many ways. We remain amid a global pandemic that has weighed heavily on all of us while placing added stress on the economy. Despite the adversity we faced in 2020, equity markets conclude the year with a strong finish . The comforting full-year returns mask the incredible volatility and stress investors faced earlier in the year. Stock markets around the world were down 30%–40% for the year by March 23, the year’s low point. From there, stocks skyrocketed into year-end. Amazingly, the major large-cap indexes are all up over 65% from their lows; smaller-cap U.S. stocks have nearly doubled since then. During the worst days of March, with pandemic fears rampant and the global economy falling off a cliff, very few predicted this year’s outsized performance for stocks.

Moving on to fixed-income, core investment-grade bonds gained a strong 7.6% for the year, providing positive returns both during and after the market crisis period. In typical fashion, early on in the year Treasuries and high-quality corporate bonds benefited from falling rates amidst a deflationary shock. Interest rates have risen modestly since the positive vaccine news in November, but they are still generally much lower than they were at the start of 2020.

Portfolio Update

In the face of a challenging and chaotic year, our client portfolios performed well. Although the first quarter was difficult, our decision in mid-March to add an increment back to U.S. stocks added value, as stocks measured by the S&P 500 are up roughly 50% from that time. Over the course of the year, we continued to add to U.S. stocks. The increased exposure to domestic equities was funded by modest reductions to our positions in foreign stocks, alternatives investments, and credit.

Looking Ahead to 2021 and Beyond

The vaccines, easy financial conditions, and stimulative fiscal policy are all reasons for our optimism for society, the economy, and markets looking ahead. The likelihood of widespread vaccine distribution supports the case for a cyclical economic recovery beginning in the second and third quarter of 2021. Central bank monetary policy is almost certain to remain very accommodative for at least the next year or two. And fiscal policy is unlikely to be restrictive and could be stimulative, depending on political outcomes. This macro backdrop should be supportive of equities and other financial risk assets, at least for the next year.

U.S. stocks continue to have high absolute valuations, but they do not look expensive relative to extremely low bond yields. We continue to maintain a position in foreign equities, which trade at a significant discount relative to domestic stocks. If the U.S. dollar, which tends to move opposite global growth, continues its recent decline amid a worldwide economic recovery, U.S. investors in non-U.S. stocks will earn an additional currency return.

We recognize our base case for a cyclical recovery and market returns for 2021 now seems to be the consensus view.

The Risks to Our Outlook

As always, there are numerous risks to our economic/market base case. Unexpected shocks can happen at any time, whether a jump in inflation, domestic political dysfunction, geopolitical conflict, or trade disputes. Financial market history teaches us to expect the unexpected and expect to be surprised.

Over the next few months, there is a risk of a sharp economic slowdown from pandemic-induced lockdowns and, potentially, inadequate additional fiscal relief for households, small businesses, and state and local government budgets. The current extreme investor optimism also leaves the market vulnerable to disappointment. But given the positive macro and investment backdrop, we would likely view any financial market drawdowns as temporary.

Looking out longer term over our five-year tactical horizon, the big risks we are watching are the specter of inflation and China.

Inflation is a lower concern at this point, but the risk isn’t zero. Rising demand stemming from spending unleashed after the pandemic could coincide with a supply side constrained by the retreat of globalization to instigate an inflationary spiral. We have inflation-sensitive investment options at our disposal should we see the need for tactical protection.

Turning to China, we are focused on the risk and opportunity it presents because of its influence within the emerging markets and the global economy. China has handled the pandemic relatively well, but its stock market has also been one of the best-performing ones in 2020. We would not be surprised to see stocks pullback, especially as China reins in excesses and reduces stimulus (after all, according to the International Monetary Fund, China is the only country expected to have generated positive GDP growth in 2020). We also expect trade and tech conflicts to continue. But longer term, we remain optimistic on China and emerging-market stocks in general. The trade war and the potential reversal of globalization have only underlined the importance of global diversification for equity investors.

Closing Thoughts

Our portfolios are well positioned for the base-case cyclical recovery from the global pandemic, but our positioning always incorporates a wide range of potentialities. We think in terms of multiple plausible scenarios, not in point estimates and dramatic binary bets. Should a less sanguine outcome occur, we have investments in the portfolio that can offer downside protection. And we are prepared to prudently, but opportunistically, respond as events unfold as we did in 2020.

The market has always exhibited dramatic mood swings, whipsawing investor sentiment, and 2020 was no different. We recommend investors ignore the crowd’s actions completely and, as we closed our first quarter letter, “stay the course.” While it’s a cliché in the investment business, that advice proved prescient this past year.

Our team will be prepared to take advantage of the market’s mood swings, as we did this past year to our clients’ benefit. We reallocated capital to stocks near the depths of fear in March and added further to equities in subsequent quarters. We’ve seen countless studies of unguided investors selling their stock exposure near the market bottom, then reinvesting as markets stabilized or fully recovered—the investor sentiment “whipsaw” effect that we often warn about.

Here’s to saying goodbye to an unfortunate year we are all eager to leave behind and to welcoming a hopefully brighter 2021. We wish everyone a healthier, happier, and prosperous New Year.

– OJM Group Investment Team