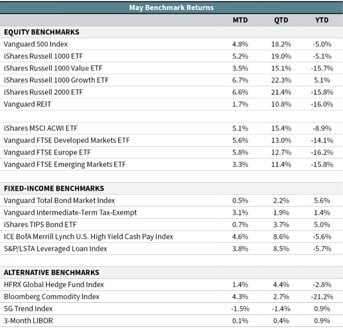

Stock markets continued their climb higher in May, adding to their strong returns in April. For the month of May, larger-cap U.S. stocks gained 4.8% and smaller-cap U.S. stocks jumped 6.6%. Equity markets are off to a roaring start in the second quarter—with larger-cap stocks and smaller-caps returning 18.2% and 21.4%, respectively, over the last two months. When looking at year-to-date returns, the strong returns since the March lows have masked the sharp drawdown in February and March. The S&P 500 fell 34% from its February high, but since March 23 the index has rallied 36% through the end of May. Larger-cap U.S. stocks are now down just 5% since the start of the year.

In the span of just three months we have endured events that echo three very difficult periods in our country’s history: a pandemic (1918), Great Depression–like unemployment (the 1930s), and civil unrest (the late 1960s). Combine those three events and you get 2020.

Reconciling the current macro environment with strong equity market gains can be a head scratcher. As we mentioned in our recent communication, the explanation is financial markets are forward-looking. With many states starting to reopen, investors are focused on the resumption of economic activity. They also appear to be assuming a best-case scenario in which COVID-19 is contained and a damaging second wave of infections is avoided. Investors are far more optimistic about the future direction of the economy than they were a couple of months ago. It is yet to be determined whether the economy and corporate earnings will live up to current investor expectations or fall short. However, the pace, strength, and duration of any economic recovery remains highly dependent on the trajectory of the pandemic, which will be impacted by social distancing, testing, tracing, treatment, vaccines, etc., in the months ahead.

Developed international stock markets fared a little better than U.S. markets last month. The Vanguard FTSE Developed Markets ETF gained 5.6% in May. France and Germany proposed a €500 billion European Union recovery fund for Europe in May, which the market saw as a positive step forward for the region and a potential kicking-off point for the fiscal integration that the more frugal Northern European countries have long opposed. Meanwhile in developing markets, U.S.-China relations started to creep back into the headlines, particularly with China’s approval of a controversial national security law for Hong Kong. The Vanguard FTSE Emerging Markets ETF returned 3.3% in May.

Interest rates have been largely unchanged over the last two months. Since April, the 10-year U.S. Treasury yield has traded in a tight range around 0.7%. U.S. core bonds returned 0.5% in May.

—OJM Group Investment Team (6/4/20)