March Investment Update

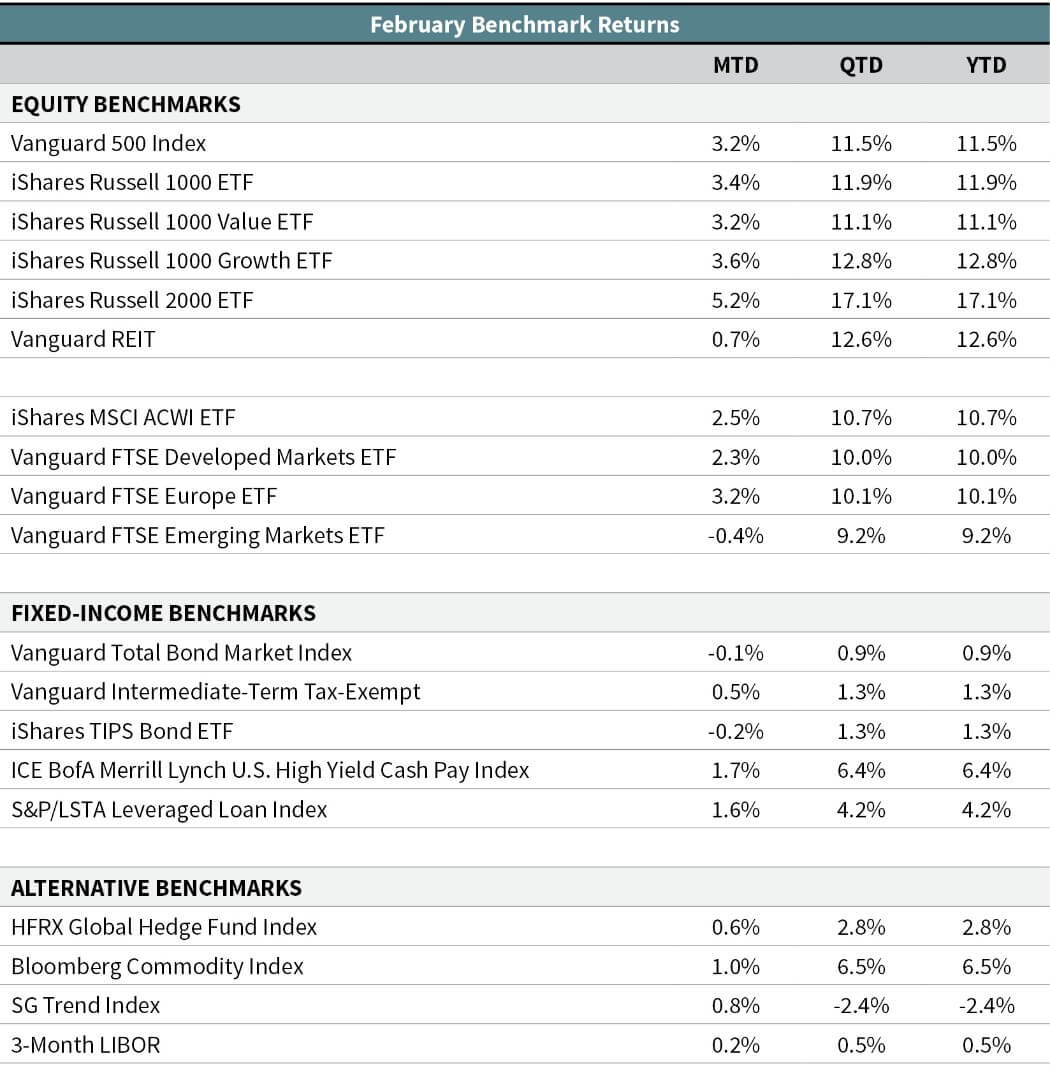

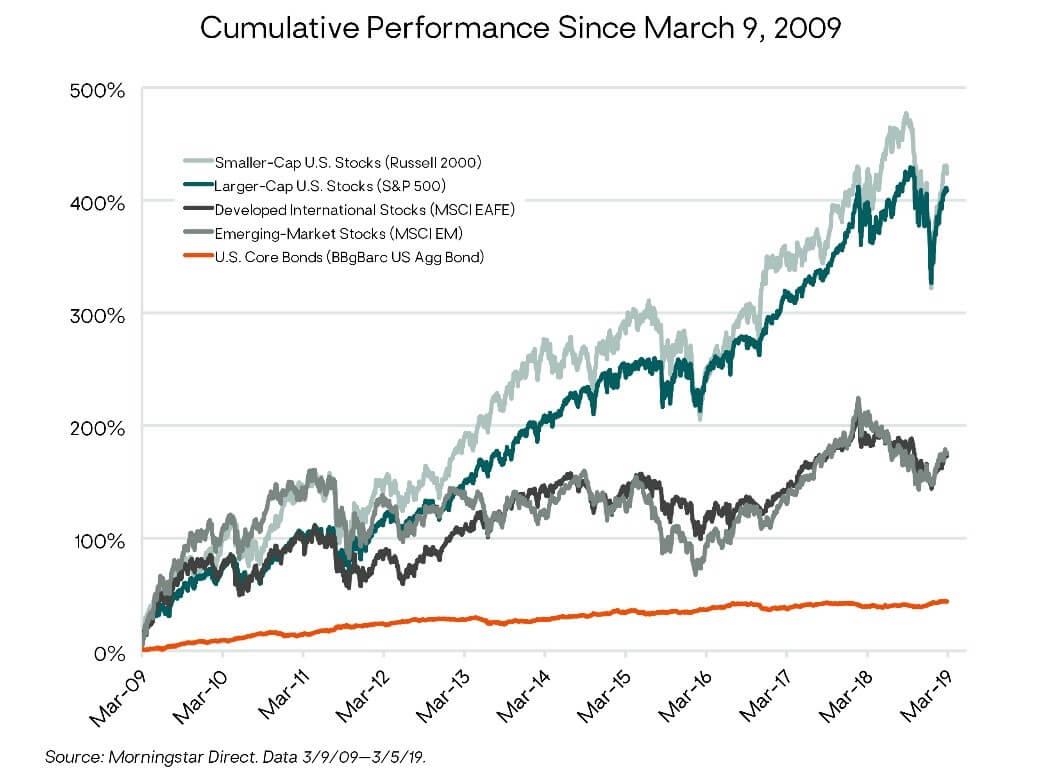

U.S. stocks continued their strong start to 2019. In February, larger-cap and smaller-cap stocks gained 3.2 percent and 5.2 percent, respectively. Year-to-date returns already stand at 11.5 percent for larger-cap U.S. stocks and 17.1 percent for smaller-cap U.S. stocks (Vanguard 500 Index and iShares Russell 2000 ETF, respectively). This month marks the 10th anniversary of the current bull market. On March 9, 2009, equity markets around the world bottomed and started their process of recovery. The returns from the bottom are pretty astonishing (even when accounting for the fact we are cherry-picking the exact low in the market). Larger-cap U.S. stocks are up more than 400 percent cumulatively, or 17.7 percent annualized since then. The chart below shows returns for strategic asset classes since the start of this bull market.

Clearly, the leadership of U.S. stocks in the current bull market relative to international equities is stark. Despite this we believe investing in foreign markets makes sense from a strategic and tactical standpoint. Since March 9, 2009, international equities have provided a more than adequate level of absolute returns: MSCI EAFE is up an annualized 10.6 percent and MSCI Emerging Markets has gained 10.7 percent. If investors were asked in March 2009 if they would be happy with 10 percent annualized returns over the next decade, most would have gladly accepted those returns.

Speaking of foreign equities, developed international stocks gained 2.3 percent in February and are up 10 percent so far in 2019 (Vanguard FTSE Developed Markets ETF). Emerging-market stocks fell 0.4 percent last month but remain up 9.2 percent this year (Vanguard FTSE Emerging Markets ETF). International markets continue to face uncertainty over U.S. and China trade negotiations, slowing Chinese and European economies, and Brexit negotiations.

U.S. core investment-grade bonds fell modestly (down 0.1 percent) in February but remain in positive territory for the year (Vanguard Total Bond Market Index). Both high-yield bond and floating-rate loan markets performed well last month with gains of 1.7 percent and 1.6%, respectively (ICE BofA Merrill Lynch U.S. High Yield Cash Pay Index and S&P/LSTA Leveraged Loan Index, respectively). U.S. Treasury rates didn’t move much during the month—the 10-year rate has traded in the 2.6 percent to 2.7 percent range for most of the year. The short end of the Treasury curve remains inverted (i.e., six-month and one-year rates remain higher than two-year, three-year, and five-year Treasury rates). Bond market investors could be signaling a couple of things by inverting the short end, such as concerns around slowing economic growth or an expectation that the Fed will cut interest rates. Most investors focus on the inversion between the short-end (three-month or two-year rates) and long-term rates (10-year) as a predictor of recession. This area of the curve remains in positive territory.

— OJM Group Investment Team (3/6/19)