February Investment Update

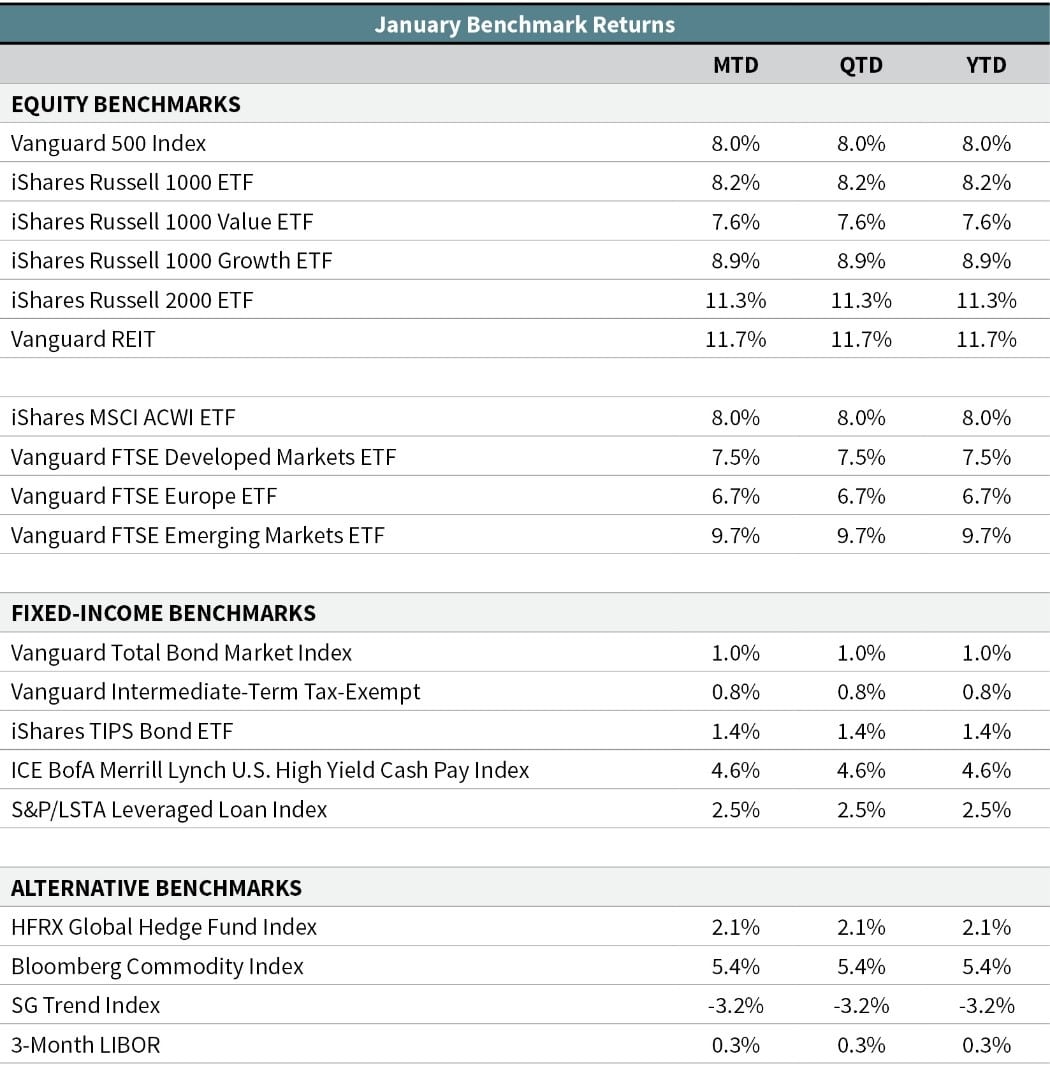

Equity markets around the world rallied in January following a December that was one of the worst on record. U.S. stocks gained 8 percent in January—the S&P 500’s best start to a year in 32 years.

Markets shrugged off a five-week partial U.S. government shutdown that started over the holidays and lasted well into January. Putting aside the adverse effects the shutdown had on many federal workers, the non-partisan Congressional Budget Office (CBO) estimated that the shutdown reduced GDP by $3 billion in the fourth quarter of 2018 and will hit the economy for another $8 billion in the first quarter. However, the CBO estimates that $8 billion of the $11 billion will be recouped in subsequent quarters. Thus, a total of $3 billion in economic activity is estimated to have been lost. To put this number in context, it is 0.01 percent of the $21 trillion U.S. economy (2019 GDP estimate). The effect on the economy is minimal from a dollars and cents standpoint and something we pay little attention to as part of our investment process. Knowing the exact date when the government would reopen wouldn’t have been much help for investors. Unfortunately, the shutdown had its biggest impact on federal workers.

Foreign equities also had a strong start to the year. The MSCI ACWI ex USA index jumped 7.6 percent—its best start in 25 years. Emerging-market stocks (Vanguard FTSE Emerging Markets ETF) built on their strong fourth quarter and gained 9.7 percent in January. Developed international stocks (Vanguard FTSE Developed Markets ETF) also had strong returns with a 7.5 percent gain. European stocks (Vanguard FTSE Europe ETF) returned 6.7 percent in January. Continued uncertainty around Brexit remains in the headlines. The U.K. Parliament voted overwhelmingly against Prime Minister Theresa May’s Brexit deal in mid-January, which had taken two years to get agreement on. The United Kingdom has until March 29 to come to a deal with the European Union on the terms of its departure, or to kick the can further down the road.

U.S. core investment-grade bonds gained 1 percent during January (Vanguard Total Bond Market Index). High-yield and floating-rate loan markets performed even better—gaining 4.6 percent and 2.5 percent, respectively (the ICE BofA Merrill Lynch U.S. High Yield Cash Pay Index and the S&P/LSTA Leveraged Loan Index). Treasury rates were largely unchanged in the month: the short-end of the yield curve hovered around 2.4 percent and the longer 10-year rate stayed in the mid-2.6 percent range.

At the end of the month, Fed chair Jerome Powell delivered what the market deemed to be a dovish stance on interest rates. The FOMC left the federal funds rate unchanged at 2.25 percent–2.5 percent. In his news conference, Powell was quoted as saying the “case for raising rates has weakened somewhat,” and also indicated the shrinkage of the Fed’s balance sheet (quantitative tightening) may slow, pause, or even reverse. The FOMC statement said: “In light of global economic and financial developments and muted inflation pressures, the Committee will be patient as it determines what future adjustments to the target range for the federal funds rate may be appropriate to support these outcomes.” The market interpreted this as the Fed pausing future rate hikes and the base case for many investors is for no hikes in 2019. The futures market currently pegs an 83 percent probability that the fed funds rate is left unchanged this year—and has a slightly higher probability for one rate cut than it does for one rate hike (11 percent and 6 percent probabilities, respectively). Risk assets took the FOMC statement positively—the Powell Put is in place, for now.

—OJM Group Investment Team (2/6/19)